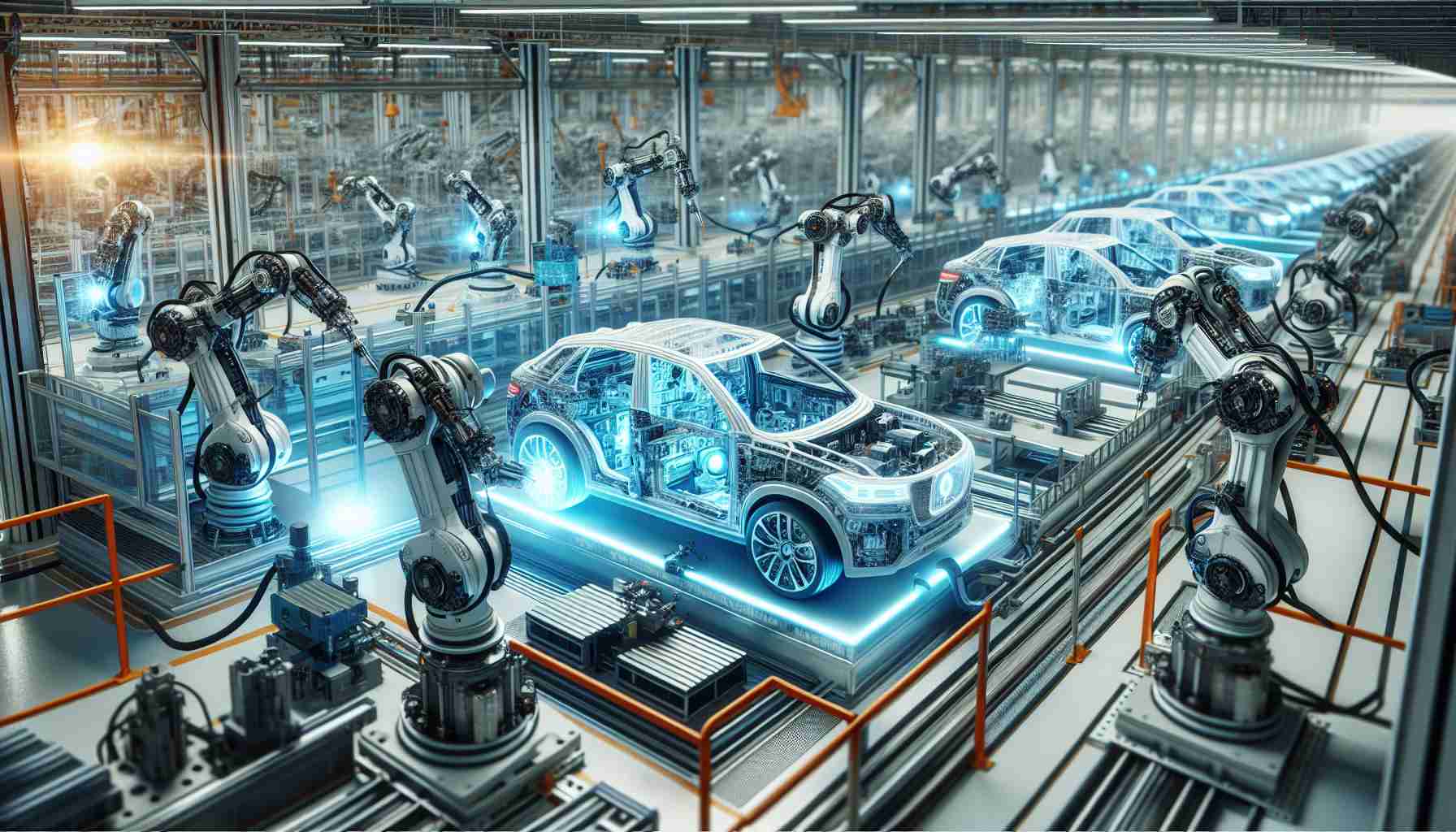

The automotive giant GM is making significant changes that will impact the future of autonomous vehicles. The company has decided to halt funding for Cruise LLC’s robotaxi initiatives, attributing this decision to prolonged development timelines, escalating costs, and fierce competition in the robotaxi industry.

Since acquiring Cruise in 2016, General Motors has invested upwards of $10 billion. This includes an infusion of $850 million in June, despite Cruise reporting a staggering loss of $3.48 billion in 2023. Now, GM plans to merge the technical teams of Cruise and GM, streamlining efforts toward enhancing autonomous driving technologies. The future of Cruise’s workforce remains uncertain, as it is yet to be decided how many employees will transition to GM.

Mary Barra, GM’s chair and CEO, emphasized the company’s commitment to fostering exceptional driving experiences while being disciplined about capital expenditure. She acknowledged Cruise’s innovative contributions to autonomy and expressed optimism about the integration of GM’s extensive resources with Cruise’s talents.

Currently, GM controls about 90% of Cruise and is expected to raise this ownership to 97% as part of a planned restructuring to refine Cruise’s focus.

In other news, Universal Robots A/S aims to bolster its foothold in the rapidly growing Chinese market by establishing a new production facility and launching two exclusive robot models, the UR7e and UR12e, designed specifically for various industries in the region. Meanwhile, the Moxie robot creators at Embodied reportedly face financial challenges, leading to their shutdown.

GM Restructures for the Future of Autonomous Vehicles: What You Need to Know

GM’s Shift in Strategy for Cruise LLC

General Motors (GM) is implementing major changes that will reshape the landscape of autonomous vehicles, particularly impacting its subsidiary, Cruise LLC. The renowned automotive company has decided to halt the funding for Cruise’s ambitious robotaxi initiatives due to several challenges, including extended development timelines, rising costs, and stiff competition within the robotaxi sector.

Since GM’s acquisition of Cruise in 2016, the automotive giant has poured over $10 billion into the autonomous driving venture. Despite this investment, Cruise reported a staggering loss of $3.48 billion in 2023. In light of these financial hurdles, GM is refocusing its efforts by merging the technical teams of Cruise and GM to streamline the development of autonomous driving technologies.

Future of Workforce and Ownership

As part of this restructuring, uncertainties loom over Cruise’s workforce as the integration process proceeds. It remains to be seen how many employees from Cruise will transition to GM. Currently, GM holds about 90% ownership of Cruise, with plans to increase this to 97% to better align both companies’ objectives and consolidate efforts in the competitive autonomous vehicle market.

Insights from GM’s Leadership

Mary Barra, GM’s chair and CEO, emphasized the company’s commitment to innovative driving experiences while maintaining a disciplined approach to capital allocation. She acknowledged Cruise’s vital contributions to the field of autonomy but indicates that GM will leverage its extensive resources to reinforce Cruise’s potential.

Market Innovations and Trends

The autonomous vehicle market is evolving rapidly, with numerous companies vying for dominance. GM’s restructuring strategy reflects broader trends in the industry, which include merging resources to enhance technological advancements and drive down costs.

Comparison with Competitors

As GM adjusts its approach, it faces intense competition from other players in the autonomous vehicle arena. Companies like Waymo, Tesla, and even emerging startups are relentlessly pushing the boundaries of technology to capture market share, which adds pressure to GM’s streamlined strategy.

Limitations and Challenges Ahead

Despite the focus on integration and efficiency, GM must navigate several challenges, including regulatory hurdles, public acceptance of autonomous technology, and the financial implications of ongoing investments. Additionally, competition from well-funded tech companies poses a significant risk, making it critical for GM to execute its plans effectively.

Predictions for the Future of Autonomous Vehicles

Looking ahead, industry experts predict that the autonomous vehicle market will expand significantly as technology matures and public acceptance grows. Companies that can effectively manage costs while innovating will likely emerge as leaders.

For further updates on GM’s developments and the autonomous vehicle market, visit General Motors.