Analyzing Ecovacs Robotics’ Future Potential

Ecovacs Robotics Co., Ltd. has experienced a notable surge in share prices recently, capturing the attention of investors. Despite not being the largest player in the market, this mid-cap stock has shown resilience and potential, albeit not yet reaching its yearly highs.

Recent evaluations suggest that shares of Ecovacs Robotics are currently trading approximately 20% below their intrinsic value. This finding implies that purchasing shares at this time could be a reasonable investment. If the stock is indeed worth around CN¥62.85, growth possibilities may be limited at its current level.

The volatility of Ecovacs Robotics means there may be further chances to buy at a lower price in the future. The stock’s high beta indicates it fluctuates significantly compared to market trends, presenting an opportunity for strategic investors.

Looking ahead, expectations are optimistic as analysts anticipate that earnings could double in the next few years. This promising forecast suggests improved cash flows and, eventually, a potential increase in share value.

For current shareholders, it appears the market has already integrated the company’s positive prospects into its current share price. As for potential investors, it might be wise to consider other critical factors such as the company’s balance sheet strength, particularly if prices drop below fair value again.

To understand more about Ecovacs Robotics, including potential risks, further analysis may be required.

Unlocking the Future of Ecovacs Robotics: Insights and Predictions

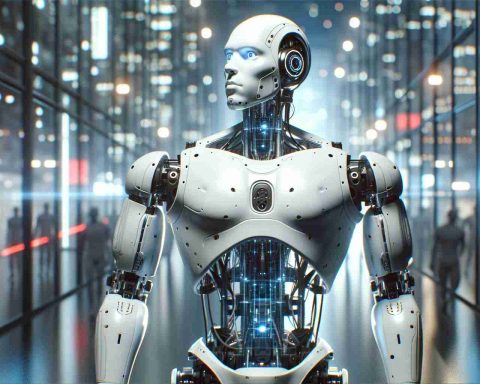

Overview of Ecovacs Robotics

Ecovacs Robotics Co., Ltd. has garnered significant attention in the stock market due to recent fluctuations in share prices. Defined as a mid-cap stock, Ecovacs is not the leading entity in its industry; however, its resilience and innovation place it in a favorable position for future growth. With shares trading approximately 20% below their intrinsic value, the company presents a potentially solid investment opportunity for strategic buyers.

Current Market Analysis

Analysts have conveyed optimism regarding Ecovacs’ future, predicting that the company’s earnings could double within the next few years. This projection stems from anticipated improvements in operational efficiency and cash flow generation. Investors are keenly monitoring these developments, especially as the stock experiences volatility, which is characterized by a high beta. This indicates significant price fluctuations compared to broader market trends, representing both risk and opportunity.

Pros and Cons

# Pros:

– Growth Potential: Expected earnings growth offers a positive long-term investment outlook.

– Market Position: Emerging as a key player in the robotics market with innovative products.

– Valuation Opportunity: Current prices suggest potential for significant returns if the stock rebounds.

# Cons:

– Volatility Risks: High beta can lead to unpredictable price movements, posing a risk to investors.

– Market Competition: Intense competition in the robotics sector could hinder market share growth.

– Debt Equities: Investors should assess the balance sheet to ensure the company maintains manageable debt levels.

Future Predictions and Trends

In terms of market trends, there is a growing demand for automation and robotics in household applications, influenced by shifts in consumer behavior toward smart home technologies. Ecovacs Robotics is well-positioned to benefit from this demand, especially as it continues to innovate and expand its product line.

Sustainability and Innovations

Sustainability is becoming a key consideration in robotic manufacturing. Ecovacs is recognized for its commitment to sustainable practices, focusing on energy-efficient designs and recyclable materials in its robotic systems. This not only enhances the company’s brand value but also aligns with global trends toward sustainability in consumer goods.

FAQs

Q: What are the key products offered by Ecovacs Robotics?

A: Ecovacs Robotics specializes in automatic cleaning devices, including robot vacuums and mops, enhanced with smart connectivity features.

Q: How does Ecovacs Robotics stand in terms of financial stability?

A: Investors should examine Ecovacs’ balance sheet closely; while current investments seem promising, one must consider any outstanding debt and its implications for future growth.

Conclusion

Investing in Ecovacs Robotics could offer significant opportunities amidst current valuations and market dynamics. As analysts project robust earnings growth, investors are advised to maintain awareness of the company’s performance against market trends and assess potential risks and rewards. With its focus on innovation and sustainability, Ecovacs Robotics is poised to thrive in the evolving landscape of household automation. For more insights, visit this link.