The landscape of AI stocks is rapidly changing, and one name stands out: UiPath Inc. (NYSE:PATH). As major stock indexes tumbled recently, driven by Nvidia’s decline, investors turned their focus to upcoming inflation data that could influence the market’s trajectory.

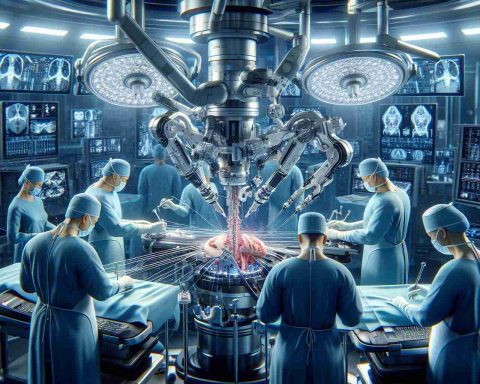

In the midst of this uncertainty, many analysts remain optimistic about the tech sector’s future. There’s a strong belief that investments in infrastructure and cybersecurity will soar by 2025, largely fueled by the ongoing AI revolution. According to BlackRock, as data’s value increases, companies will prioritize spending on cybersecurity measures to protect it. This trend promises robust growth for AI firms and cybersecurity providers alike.

During a recent earnings report, UiPath showcased remarkable results, with a 9% increase in revenue year-over-year, totaling $355 million. Their annual recurring revenue also saw a significant rise to $1.607 billion, highlighting the effectiveness of their AI-driven automation solutions. The successful launch of new products, such as UiPath Autopilot™, demonstrates the company’s commitment to innovation and efficiency in enterprise automation.

Despite being recognized as a key player in the AI stock sector, some analysts suggest that other stocks may present better investment opportunities. For those searching for promising AI stocks trading at attractive valuations, there are options available that may outperform UiPath in the near future.

Is UiPath the Next Big AI Investment? Discover Insights and Trends

## The Changing Landscape of AI Stocks

The world of artificial intelligence (AI) stocks is dynamic and potentially lucrative, with notable companies such as UiPath Inc. (NYSE: PATH) making headlines. Recent market fluctuations, particularly the impact of Nvidia’s stock performance, have influenced investor sentiment, pushing many to seek out valuable insights and trends that could shape investment strategies.

Market Trends Impacting AI Stocks

1. Infrastructure and Cybersecurity Investment: Analysts predict that by 2025, spending on infrastructure and cybersecurity will significantly increase as companies recognize the critical need to protect their data. The AI revolution is a driving factor behind this trend, as organizations accumulate vast amounts of information that require safeguarding.

2. Growing Importance of Cybersecurity: According to insights from BlackRock, as the value of data escalates, businesses are expected to prioritize cybersecurity expenditures. This shift not only underscores the importance of AI in enhancing security measures but also presents a promising avenue for growth in both AI and cybersecurity sectors.

Performance Highlights of UiPath

In their latest earnings report, UiPath revealed substantial growth:

– Revenue Growth: The company reported a 9% year-over-year revenue increase, amounting to $355 million.

– Annual Recurring Revenue (ARR): UiPath’s ARR rose impressively to $1.607 billion, indicating strong demand for their AI-driven automation solutions.

– Innovation in Products: The introduction of UiPath Autopilot™ showcases the company’s focus on cutting-edge technology to optimize enterprise automation processes, further solidifying its position in the market.

Investment Considerations

Despite the positive developments surrounding UiPath, some analysts caution investors to explore other AI stock options that might offer better opportunities. Here are key considerations:

# Pros and Cons of Investing in UiPath

Pros:

– Strong revenue growth and increasing ARR highlight the effectiveness of the company’s business model.

– Ongoing commitment to innovation positioning them as a leader in enterprise automation.

Cons:

– Competitive market with numerous alternatives may affect UiPath’s market share.

– Some analysts suggest that other AI stocks could outperform UiPath given the current valuation landscape.

Future Predictions and Insights

As the AI landscape evolves, predictions about the sector’s trajectory point towards sustained growth. Companies leveraging AI for automation and cybersecurity are poised to benefit handsomely from emerging trends. Investors are advised to keep a close watch on:

– Innovative solutions and products launched by leading AI firms.

– The continuous evolution of market dynamics, especially in light of global economic factors.

– Strategic partnerships and investments that enhance technological capabilities in AI and cybersecurity.

Conclusion

Investing in AI stocks like UiPath holds considerable promise amid evolving market conditions. As stakeholders navigate a complex landscape shaped by technological advancements and economic shifts, informed decision-making will be crucial. With growing trends in cybersecurity and automation, the focus remains on finding the right opportunities within the burgeoning AI market.

For more insights on investments and market trends, check out BlackRock.