Exploring the Innovations of Symbotic and Its Market Potential

The rise of artificial intelligence (AI) took a significant leap with the launch of OpenAI’s ChatGPT in late 2022, igniting a surge of interest in AI technologies. Amidst this excitement, investors are searching for the next big opportunity in the AI landscape. One contender to watch is Symbotic, a robotics firm specializing in AI-driven warehouse automation.

Symbotic’s platforms integrate advanced robotics to enhance freight processing efficiency, emulating the operational prowess of major retailers like Amazon. The growing warehouse automation sector, valued over $23 billion in 2023, is projected to expand to $41 billion by 2027, underscoring the timing of Symbotic’s technologies.

Although Symbotic’s stock experienced a 45% drop in 2024 so far, this could present a noteworthy investment window. The company’s innovative robots continuously learn, enabling them to optimize functions and minimize errors, which has attracted clients such as Walmart. Symbotic’s partnership with Walmart maintains a long-term contract valid until 2034.

Despite a substantial revenue increase of 52% to $1.8 billion in fiscal 2024, the company reported a net loss. However, it achieved profitability in the last quarter, signaling potential for future growth. Their collaboration with SoftBank on the GreenBox initiative focuses on expanding globally, with plans to move beyond the North American market.

Investors should carefully evaluate the balance between risk and growth potential, especially given Symbotic’s reliance on Walmart for the majority of its sales. For now, as the company proves its ability to sustain profitability, it may become a key player for those willing to embrace the inherent risks associated with emerging AI technologies.

Symbotic: Pioneering Warehouse Automation with AI Innovations

Understanding Symbotic’s Innovative Edge

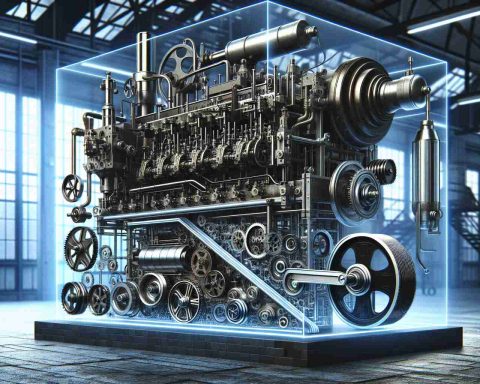

Symbotic has emerged as a significant player in the warehouse automation industry, leveraging cutting-edge AI and robotics technologies to optimize supply chain operations. The company’s robotic systems are designed to automate and enhance freight processing efficiency, which is particularly crucial as global e-commerce demands surge.

Market Potential and Growth Trend

The warehouse automation market is experiencing rapid growth. Valued at over $23 billion in 2023, it is expected to reach approximately $41 billion by 2027. This growth is driven by increasing demand for efficient inventory management and distribution channels, particularly among major retailers.

Key Features of Symbotic’s Technology

Symbotic’s platforms are characterized by several innovative features:

– Robust Robotics: Their autonomous robots handle various tasks, such as sorting, storing, and retrieving goods, significantly reducing human labor.

– AI Integration: The robots utilize machine learning algorithms to continually improve operational efficiency, minimizing errors and enhancing productivity.

– Scalability: The technology is designed to be scalable, making it adaptable for different warehouse sizes and complexities.

Pros and Cons of Investing in Symbotic

# Pros:

– Strong Market Position: With partnerships like Walmart, Symbotic is well-positioned to capture a significant share of the growing automation market.

– Innovative Technology: Continuous improvements in AI-driven robotics could lead to sustained operational efficiencies for clients.

# Cons:

– Current Financial Risks: The recent dip in stock value (45% in 2024) and previous net losses highlight potential financial volatility.

– Dependency on Major Clients: A significant portion of revenue comes from Walmart, which could expose the company to risks if the partnership faces challenges.

Use Cases of Symbotic’s Solutions

Symbotic’s solutions are particularly advantageous for:

– Retail Chains: Large retailers can streamline their inventory and distribution processes.

– E-commerce Fulfillment Centers: Automated systems facilitate rapid order processing and delivery.

– Grocery Distribution: Efficient handling of food items, which often require different storage and transport conditions.

Future Innovations and Security Aspects

As Symbotic continues to innovate, several trends are expected to shape its future:

– Enhanced AI Capabilities: Future updates to robotic systems may incorporate more advanced AI, leading to better decision-making in inventory management.

– Focus on Security: With increased automation comes the necessity for robust cybersecurity measures to protect sensitive data related to supply chain operations.

Pricing and Market Analysis

Investors should note that pricing for Symbotic’s solutions can vary greatly depending on the scale of deployment and specific needs of the business. However, the potential for significant long-term savings often justifies the initial investment.

As Symbotic seeks to expand its footprint beyond North America, the collaboration with SoftBank on the GreenBox initiative could pave the way for lucrative opportunities in international markets.

Conclusion: A Future of Opportunity and Risk

Symbotic stands at the forefront of the warehouse automation revolution. While the reliance on key clients poses certain risks, the potential for growth in a rapidly evolving market holds promise for investors willing to navigate the uncertainties. As the company continues to innovate and achieve profitability, it may very well emerge as a critical player in the landscape of AI-driven warehouse solutions.

For more on automation technologies, visit Symbotic’s main site.