- AMD faces a 40% stock decline despite record revenue in Q4 2024, amid market challenges and export restrictions to China.

- The company focuses on artificial intelligence, planning the mid-2025 launch of the MI350 AI accelerator to compete with Nvidia.

- Strong growth in server CPU market share and 175% year-over-year EBIT increase in 2024 highlight AMD’s strategic shift towards data centres.

- Some investors view the stock decline as an opportunity, due to AMD’s solid foundational strategies and AI market potential.

- Wall Street remains optimistic about AMD, reflecting a Moderate Buy rating and a promising 12-month price target.

- AMD is positioned as a key player in the evolving AI-driven tech landscape, with potential for significant future growth.

Picture this: a tech giant grappling with tumultuous market waves, yet resilient and poised to unleash its next big innovation. Advanced Micro Devices, Inc. (AMD) serves as a compelling study of contrast in the fast-paced semiconductor landscape. Over the past year, shareholders have witnessed the stock plunge about 40%, shadowing record revenue triumphs reported in the dazzling fourth quarter of 2024. Yet, amid the market turbulence and rising export restrictions to China, AMD’s vision remains unblurred as it bets heavily on the future of artificial intelligence.

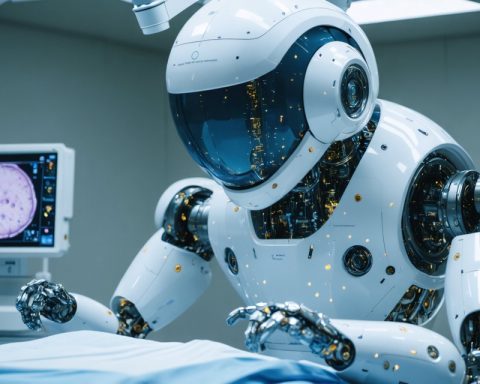

The narrative of AMD is not merely one of falling stock prices but an odyssey into the heart of technological transformation. CEO Lisa Su and her team are rallying forces, preparing to launch the MI350, a next-generation AI accelerator anticipated in mid-2025. This advancement could potentially reshape AI performance, echoing through data centres worldwide. The countdown to this release is a testament to AMD’s unwavering commitment to innovation and a fresh battlefield against industry giant Nvidia.

Beyond the immediate challenges, AMD’s foray into data centres paints a brighter picture. The company has been gaining impressive market share in server CPUs through its robust EPYC portfolio, underscored by a stunning 175% year-over-year EBIT growth in 2024. This growth speaks to a strategic pivot towards data-driven markets where AI and cloud infrastructure demand remain insatiable.

Some investors smell opportunity in the midst of AMD’s stock decline, citing a robust fundamental framework that anchors the company’s forward-looking trajectory. The optimistic soliloquy of investors like Oakoff Investments highlights the untapped potential poised to harvest benefits from AI infrastructure evolution. Wall Street, stirred by AMD’s prospective ascendancy, holds a largely favourable consensus, with a Moderate Buy rating reflecting cautious optimism and a 12-month price target set to offer significant upside.

AMD’s journey unrolls amid the grandeur of high tech, competition, and innovation. As the world leans increasingly towards AI-driven solutions, AMD positions itself not just as a participant, but as a formidable architect of the technological future. For those observing closely, the recent stock dip may very well prove to be the sleeping giant before its awakening. The tale of AMD is far from over; it presently basks in the glow of potential, waiting for its time in the sun.

The Future of AMD: Innovations and Market Trends to Watch

AMD’s Pivotal Role in the Semiconductor Industry

Advanced Micro Devices, Inc. (AMD) stands out as a dynamic force in the semiconductor market, demonstrating resilience in the face of fluctuating stock values. Despite a notable 40% decline in stock prices over the past year, AMD’s strategic trajectory focuses on long-term growth through innovative advancements and significant investments in artificial intelligence (AI).

Key Innovations: The MI350 Accelerator

AMD’s upcoming MI350, a next-generation AI accelerator set for release in mid-2025, is expected to redefine AI capabilities across global data centres. This cutting-edge technology aims to enhance AI performance, challenging industry competitors such as Nvidia. The MI350 represents AMD’s ongoing dedication to pioneering breakthroughs in AI and machine learning technologies.

How-To Steps & Life Hacks: Leveraging AMD for AI Development

1. Evaluate Infrastructure Needs: Assess your data centre requirements to determine the suitability of integrating AMD’s MI350 for AI workloads.

2. Plan for Integration: Develop a comprehensive strategy for incorporating the MI350 into existing systems, focusing on compatibility and performance optimisation.

3. Scale AI Capabilities: Utilise the improved performance of the MI350 to expand AI applications across verticals, from automated customer interactions to advanced predictive analytics.

4. Monitor Performance: Establish metrics to evaluate AI performance enhancements post-integration, ensuring that the MI350 meets organisational goals.

Real-World Use Cases

AMD’s expansion into data centres aligns with the increasing demand for AI and cloud infrastructure support. Organisations can leverage AMD’s EPYC portfolio to enhance server CPU performance, facilitating efficient management of large data sets and complex AI algorithms.

Market Forecasts & Industry Trends

The global AI semiconductor market is projected to grow significantly, with the rising adoption of AI technologies in various industries. AMD’s focus on AI accelerators places it in a strong position to capture market share within this rapidly expanding sector. According to MarketsandMarkets, the AI chipset market is expected to reach $57.5 billion by 2025 (source: MarketsandMarkets report).

Reviews & Comparisons: AMD vs. Nvidia

While Nvidia remains a dominant player in AI accelerators, AMD offers competitive alternatives with its MI-Series. AMD’s EPYC processors provide superior compute power, posing a viable option for enterprises looking to diversify their technology stack.

Pros & Cons Overview

Pros:

– Strong innovation with the MI350, anticipated to reshape AI performance.

– Robust growth in server CPUs, demonstrated by a 175% year-over-year EBIT growth in 2024.

– Positioned well in the AI-driven tech landscape, with increasing market share in cloud infrastructures.

Cons:

– Stock volatility may impact investor confidence.

– Facing stiff competition from established industry leaders like Nvidia.

Actionable Recommendations

1. Monitor Market Trends: Keep a close eye on AI technology trends and AMD’s product developments to stay ahead of industry shifts.

2. Explore Investment Opportunities: Consider AMD’s recent stock dip as a potential entry point for investment, keeping in mind analyst consensus of a Moderate Buy rating.

3. Stay Informed: Regularly review AMD’s financial reports and market analyses to make informed decisions regarding technology adoptions.

Conclusion

AMD is strategically positioned to capitalise on the burgeoning demand for AI and data centre solutions, leveraging innovative technologies like the MI350 AI accelerator. By staying informed and adaptable, businesses and investors alike can harness these advancements to foster growth and innovation.

For further insights into AMD’s innovations and strategic initiatives, visit the AMD official website.