- Carvana’s share price recently increased by nearly 8% amid analyst optimism.

- Analyst Alexander Potter from Piper Sandler upgraded Carvana’s rating from Neutral to Overweight, with a target price of £225, citing its resilience to new tariffs as an advantage.

- Hindenburg Research expressed skepticism about Carvana’s financial structure, labelling its recovery as a “mirage.”

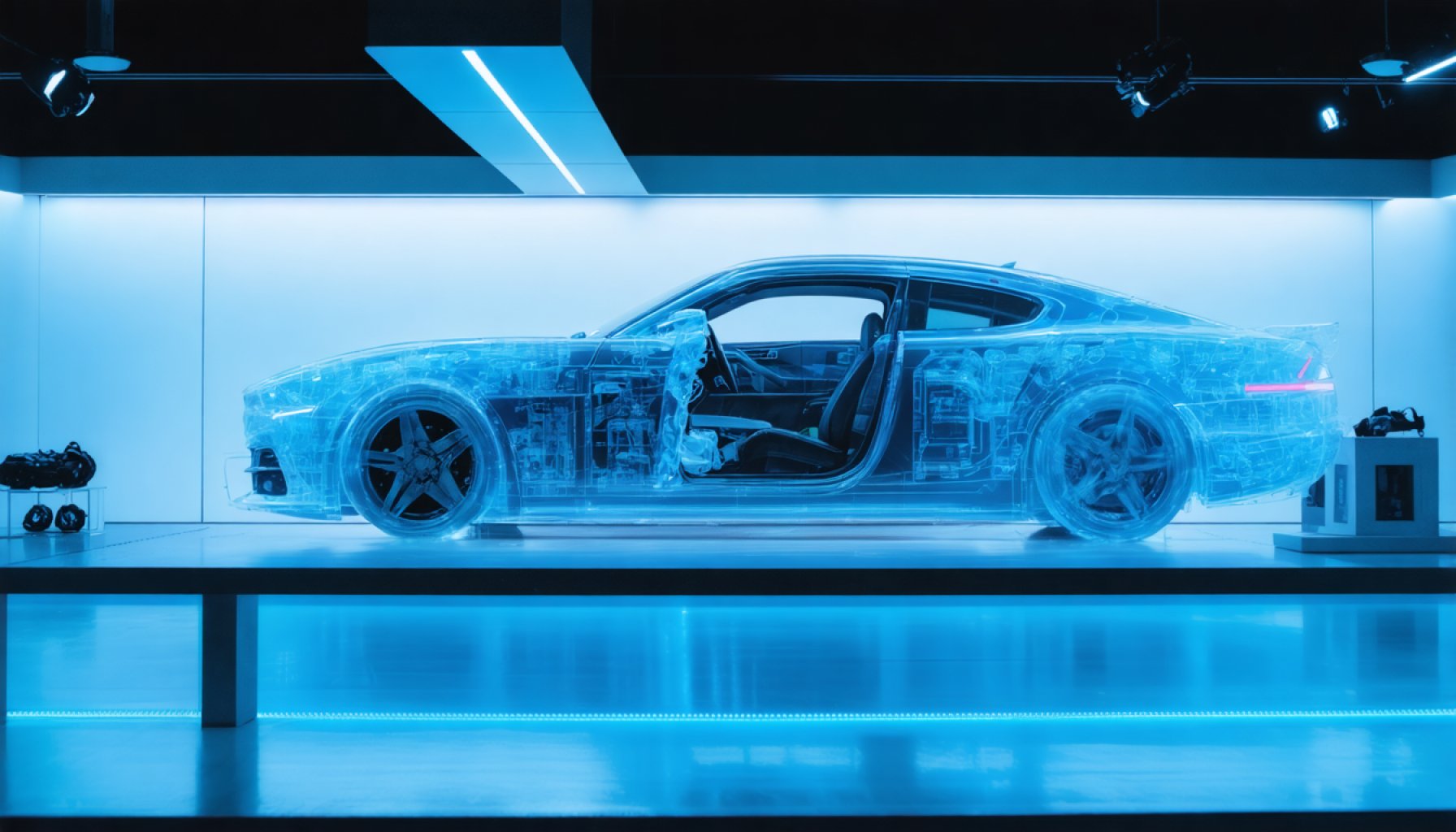

- Carvana’s unique offerings, like vehicle reconditioning and home delivery, help shield it from competitors, including Amazon.

- Wall Street shows a Moderate Buy consensus with a hopeful outlook; the stock soared 115.68% last year, with a target of £288.85, suggesting potential growth.

- Despite challenges, Carvana appeals to risk-tolerant investors for its growth potential.

The stock market is a theatre of high drama, where the roaring applause of investors often echoes the whispers of analysts. Recently, the dramatic flare-up of Carvana’s share price by nearly 8% marked another captivating scene in the turbulent tale of this used car powerhouse. What sparked such enthusiasm? According to analysts at Piper Sandler, Carvana’s journey might not be stuck in reverse after all.

Armed with a perspective of opportunity rather than caution, seasoned analyst Alexander Potter sees Carvana’s recent price dip as an opening act, rather than an epilogue. By upgrading Carvana’s rating from Neutral to Overweight, Potter posits that the stock could reach a dazzling price of £225 per share, a 27.8% climb from previous ratings. His optimism is fuelled by the notion that Carvana stands virtually untouched by looming tariffs, which threaten counterparts reliant on new imports. As a purveyor of used cars, Carvana sails through this storm with confidence, its business model providing a unique form of protection.

However, skepticism coexists with this optimism. Not long ago, the infamous research outfit, Hindenburg Research, cast a shadow on Carvana’s glowing recovery by labelling it as an ephemeral “mirage.” They painted a picture of precarious dependence on fragile financial scaffolding, underpinning their critique with undertones of skepticism towards the financial gymnastics at play.

Despite these accusations, the winds have not swept Carvana into oblivion. External threats, like potential initiatives from giants such as Amazon, loom but fail to eclipse Carvana’s distinctive services, such as vehicle reconditioning and home delivery options. These unique offerings cement its niche and provide a buffer against new competitors, even those with Amazon’s might.

With this multifaceted backdrop, the question echoes: Is Carvana a buy, sell, or hold? On Wall Street, opinions converge on cautious optimism. A Moderate Buy consensus reflects a divided, yet hopeful analyst community, balancing between eight Buys and six Holds. Recent market surges have seen Carvana’s price soar by 115.68% this past year, inducing dreams of a further 52.78% upswing, with an average target price of £288.85.

The takeaway? Carvana’s path may not be devoid of bumps and sharp turns, but the resilient company shows no signs of running out of gas soon. For adventurous investors, this might just be the perfect time to jump in and see where this rollercoaster ride takes them.

Unveiling Carvana’s Journey: The High-Stakes Drama of Used Car Sales

The Current Scene of Carvana’s Stock Performance

Carvana has emerged as a significant player in the used car market, with its stock performance creating ripples of excitement and skepticism among analysts and investors alike. While Piper Sandler’s Alexander Potter’s upgrade to ‘Overweight’ injects positivity, identifying Carvana as immune to new import tariffs, the financial market’s reactions warrant a deeper look.

Key Facts and Market Insights

– Business Model Resilience: Carvana’s model of selling used cars online is relatively impervious to the import tariffs that challenge its competition. The company’s focus on reconditioning cars and its robust home-delivery service enhance its competitive edge.

– Analyst Rating Upgrades: The upgrade from ‘Neutral’ to ‘Overweight’ suggests confidence in Carvana’s growth potential. A projection of Carvana reaching £225 per share indicates a potential rise of 27.8% based on previous assessments.

– Criticism and Controversy: Hindenburg Research’s skepticism underlines potential vulnerabilities in Carvana’s financial strategies, raising concerns about the sustainability of its rapid expansion.

Features and Unique Offerings

1. Vehicle Reconditioning: Carvana’s ability to recondition vehicles ensures quality, which builds consumer trust and supports sales.

2. Home Delivery: By offering home delivery, Carvana increases convenience for customers, a critical selling point in today’s digital-first market.

3. Innovative Technology: The use of advanced online platforms for showcasing and selling cars makes the purchasing process seamless.

Market Trends & Competitor Analysis

– Rising Demand for Used Cars: The demand for used vehicles is on an upward trajectory due to inflation and the scarcity of new cars, bolstering Carvana’s market position.

– Competitor Watch: Potential threats from new entrants such as Amazon are on the horizon, but Carvana’s established niche provides a competitive buffer.

Predicting Carvana’s Future

Despite inherent challenges, Carvana’s adaptability provides a promising outlook. With the used car market expected to grow, Carvana is well-positioned for future opportunities, although ongoing scrutiny of its financial strategies remains crucial.

Pressing Questions

– Is Carvana a Solid Investment? For investors with a higher risk tolerance, Carvana’s stock presents an opportunity for substantial gains. However, the volatility and financial health should be closely monitored.

– How Sustainable is Carvana’s Growth? The company’s growth strategies appear sustainable given the current demand for used cars, but financial integrity remains a concern as highlighted by critics.

Actionable Recommendations

1. Monitor Market Fluctuations: Investors should closely follow Carvana’s stock movements and broader market trends to make informed buying or selling decisions.

2. Diversify Investment Portfolio: Balancing investments in used car markets with other sectors can mitigate risks.

3. Keep Abreast of Analyst Updates: Regularly review updates from credible analysts to gauge market sentiment and projections.

Conclusion

Carvana’s journey is emblematic of a high-risk, high-reward scenario. Adventurous investors might find this an opportune moment to engage, provided they diligently manage and assess associated risks. Keep informed with the latest from Carvana as you explore the dynamics of the evolving auto market.