- Steve Cohen’s $1.5 billion hedge fund aims to capitalize on AI’s transformative potential.

- The U.S. and China are intensifying competition in the AI sector, influencing political agendas.

- Donald Trump advocates for faster AI infrastructure development, raising safety and transparency concerns.

- Altair Engineering ranks 5th among AI stocks, excelling in software and cloud solutions for key industries.

- Recent partnerships, like with Cranfield University, position Altair at the forefront of AI advancements in robotics and space exploration.

- Investors should consider Altair Engineering as a promising opportunity in the AI investment landscape.

In the fast-paced world of artificial intelligence, one name stands out: Altair Engineering Inc. (NASDAQ:ALTR). Recently, billionaire investor Steve Cohen made waves, declaring his unwavering faith in AI as a game-changing force for the next two decades. Despite the recent turmoil in tech stocks, spurred by Chinese startup DeepSeek’s rapid advancements, Cohen isn’t backing down. His firm is gearing up to launch a staggering $1.5 billion AI-focused hedge fund, aiming to seize the burgeoning opportunities in this transformative sector.

As the U.S. races against China in the AI arena, the political landscape is shifting. Former President Donald Trump is pushing for expedited AI infrastructure development, even reversing key regulations intended to ensure safety and transparency. With a $100 billion collaboration involving tech giants like SoftBank and OpenAI on the horizon, the call for swift progress is echoed throughout the industry, igniting optimism, yet raising eyebrows over potential risks.

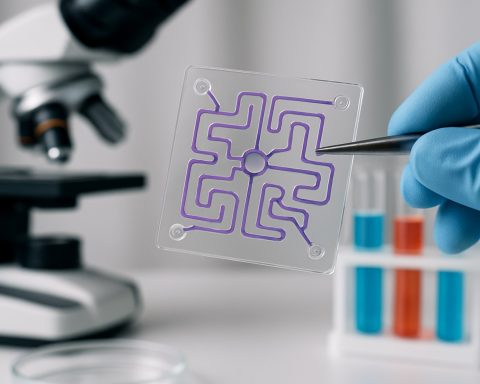

Among the top contenders in AI stocks, Altair Engineering shines brightly, securing the 5th spot on a coveted list. Specializing in software and cloud solutions for industries like aerospace and automotive, Altair is at the forefront of innovation, recently partnering with Cranfield University to explore AI advancements in robotics and autonomous space exploration.

The takeaway? If you want to ride the AI wave with investments that promise significant returns in the near term, keep your eyes on Altair Engineering. For those who seek even more hidden gems, diving into our report could reveal the cheapest AI stock trading under five times its earnings. The future of AI is unfolding—don’t get left behind!

Unlocking the Future of AI: Investment Insights and Predictions

Overview of Altair Engineering and the AI Landscape

In the rapidly evolving domain of artificial intelligence, Altair Engineering Inc. (NASDAQ:ALTR) is carving a significant niche. As investor Steve Cohen anticipates a monumental shift in the AI landscape over the next two decades, the technology sector finds itself in a fierce race, particularly between the U.S. and China. With the mounting pressure for innovation, companies like Altair are not just participants but pioneers, employing advanced software and cloud solutions that drive progress across various industries, including aerospace and automotive.

Key Insights and Trends

– Market Predictions: Analysts forecast that the global AI market could see exponential growth, with estimates suggesting it may reach $390 billion by 2025. Companies leveraging AI technologies are likely to see substantial returns on investments, making stocks like Altair potentially attractive options.

– Innovative Collaborations: Altair’s partnership with Cranfield University highlights its commitment to push the boundaries of AI applications. This collaboration aims to innovate in robotics and autonomous technologies, paving the way for future advancements in multiple sectors.

– Funding and Investment Opportunities: The financial landscape is buzzing, with Steve Cohen’s $1.5 billion hedge fund focused solely on AI. This influx of capital signifies a robust belief in the future of AI technologies and provides substantial opportunities for investors.

Pros and Cons of Investing in AI Stocks

Pros:

1. High Growth Potential: The AI sector is predicted to grow rapidly, offering significant returns for early investors.

2. Diverse Applications: AI solutions are being integrated into various fields, from automotive enhancements to aerospace innovations, broadening the market scope.

3. Enhanced Efficiency: Companies utilizing AI can streamline processes and improve decision-making, potentially boosting profit margins.

Cons:

1. Market Volatility: The tech sector is subject to rapid shifts, leading to fluctuations in stock prices.

2. Regulatory Risks: Changes in government policies can affect AI development and investment opportunities.

3. Ethical Concerns: Issues around data privacy and AI ethics can pose risks to companies in this field.

Frequently Asked Questions

1. What are the primary sectors benefiting from AI advancements?

– Sectors such as aerospace, automotive, healthcare, finance, and technology are leveraging AI for enhanced efficiency and innovative solutions.

2. How does Altair Engineering differentiate itself in the AI market?

– Altair distinguishes itself through its advanced software and cloud solutions tailored for specific industry needs, alongside strategic partnerships for research and development like the one with Cranfield University.

3. What are the potential risks associated with investing in AI stocks?

– Investors should be aware of market volatility, the possibility of changing regulations, and ethical dilemmas related to AI applications, which can impact company performance and stock value.

Conclusion

As the race for AI supremacy heats up, Altair Engineering stands out as a key player. With significant investments, innovative partnerships, and a keen focus on future technologies, the company is well-positioned for growth. Investors looking to capitalize on AI advancements should closely monitor Altair and similar firms—ensuring they remain at the forefront of this transformative wave.

For more information about investment opportunities and AI advancements, visit Altair Engineering.