Spintronic Memory Device Fabrication Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts to 2030

- Executive Summary & Market Overview

- Key Technology Trends in Spintronic Memory Device Fabrication

- Competitive Landscape and Leading Players

- Market Growth Forecasts and CAGR Analysis (2025–2030)

- Regional Market Analysis and Emerging Hubs

- Challenges, Risks, and Opportunities in Spintronic Memory Device Fabrication

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary & Market Overview

Spintronic memory device fabrication represents a cutting-edge segment within the broader non-volatile memory market, leveraging the intrinsic spin of electrons, in addition to their charge, to store and process information. As of 2025, the global spintronic memory market is experiencing robust growth, driven by escalating demand for faster, energy-efficient, and highly scalable memory solutions in data centers, consumer electronics, and automotive applications. Spintronic memory devices, such as Magnetoresistive Random Access Memory (MRAM), offer significant advantages over traditional memory technologies, including non-volatility, high endurance, and rapid read/write speeds.

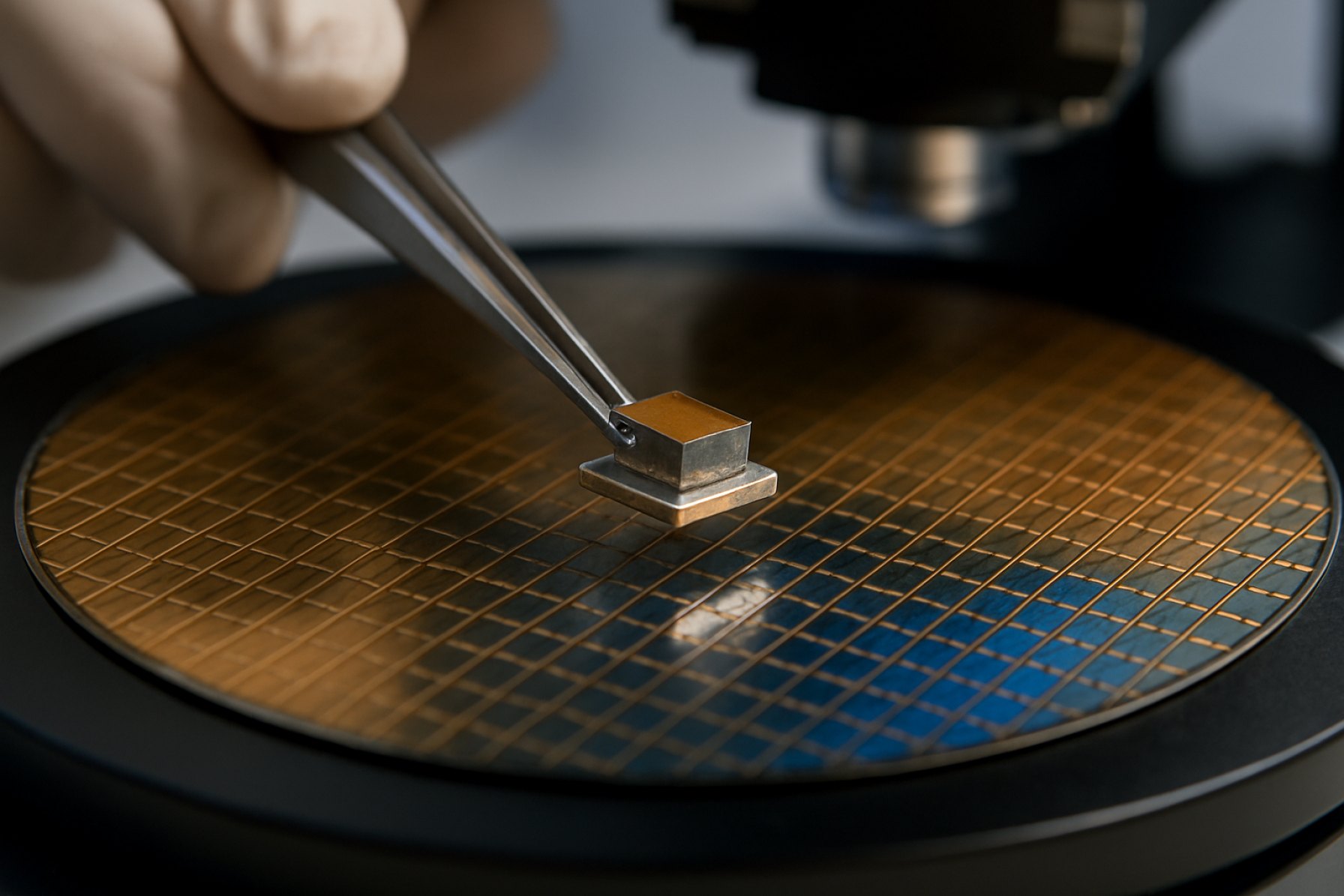

The fabrication of spintronic memory devices involves advanced thin-film deposition techniques, precise patterning, and integration of magnetic tunnel junctions (MTJs) at the nanoscale. Key players in the market, including Samsung Electronics, Toshiba Corporation, and Everspin Technologies, are investing heavily in research and development to enhance device scalability and reduce production costs. According to MarketsandMarkets, the global spintronics market is projected to reach USD 19.0 billion by 2025, with memory device fabrication constituting a significant share of this growth.

The market landscape is shaped by rapid technological advancements, such as the transition from in-plane to perpendicular magnetic anisotropy (PMA) in MTJs, which enables higher density and improved thermal stability. Additionally, the adoption of 300mm wafer processing and the integration of spintronic memory with CMOS logic circuits are accelerating commercialization efforts. Strategic collaborations between semiconductor foundries and material suppliers, such as TSMC and Applied Materials, are further streamlining the fabrication process and enhancing yield rates.

- Growing demand for AI and IoT devices is fueling the need for high-performance, low-power memory solutions.

- Automotive and industrial sectors are increasingly adopting spintronic memory for its reliability in harsh environments.

- Government initiatives in the US, EU, and Asia-Pacific are supporting R&D and pilot production lines for next-generation memory technologies.

In summary, the spintronic memory device fabrication market in 2025 is characterized by technological innovation, strategic partnerships, and expanding end-use applications, positioning it as a pivotal segment in the future of semiconductor memory solutions.

Key Technology Trends in Spintronic Memory Device Fabrication

Spintronic memory device fabrication is undergoing rapid evolution, driven by the demand for faster, more energy-efficient, and scalable non-volatile memory solutions. In 2025, several key technology trends are shaping the landscape of spintronic memory device manufacturing, particularly in the context of Magnetoresistive Random Access Memory (MRAM) and related technologies.

- Advanced Materials Engineering: The integration of novel materials such as Heusler alloys, topological insulators, and two-dimensional (2D) materials is enhancing spin injection efficiency and thermal stability. These materials offer higher spin polarization and lower damping, which are critical for reducing write currents and improving device endurance. Research from IBM Research and Toshiba highlights ongoing efforts to optimize material stacks for next-generation MRAM.

- Scaling and Patterning Innovations: As device dimensions shrink below 20 nm, advanced lithography techniques such as extreme ultraviolet (EUV) and directed self-assembly (DSA) are being adopted to achieve precise patterning of magnetic tunnel junctions (MTJs). These approaches are essential for maintaining high yield and uniformity at the wafer scale, as reported by Applied Materials.

- Voltage-Controlled Magnetic Anisotropy (VCMA): VCMA is emerging as a promising mechanism to reduce switching energy in spintronic devices. By leveraging electric fields to modulate magnetic properties, manufacturers can achieve lower power consumption and faster switching speeds, a trend underscored in recent publications from Samsung Semiconductor.

- Integration with CMOS Processes: Seamless integration of spintronic memory with standard CMOS logic is a major focus. Foundries are developing back-end-of-line (BEOL) compatible processes to enable monolithic integration, which is crucial for commercial adoption in embedded memory applications, as detailed by TSMC and GlobalFoundries.

- Automated Process Control and Metrology: The complexity of spintronic device stacks necessitates advanced in-line metrology and process control. Real-time monitoring of layer thickness, interface roughness, and magnetic properties is being enhanced through AI-driven analytics, as implemented by KLA Corporation.

These trends collectively point toward a future where spintronic memory devices offer superior performance, scalability, and integration potential, positioning them as a cornerstone of next-generation memory technologies in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of spintronic memory device fabrication in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized materials companies, and innovative startups. The market is driven by the race to commercialize next-generation non-volatile memory technologies, such as Magnetoresistive Random Access Memory (MRAM), which leverage spintronic principles for superior speed, endurance, and energy efficiency compared to traditional memory solutions.

Leading players in this space include Samsung Electronics, which has made significant investments in MRAM research and has begun integrating embedded MRAM (eMRAM) into its advanced process nodes for applications in automotive and IoT. TSMC is also actively developing spintronic memory solutions, collaborating with materials suppliers and research institutes to optimize fabrication processes for high-volume manufacturing.

Another key player, GlobalFoundries, has announced the successful qualification of its 22FDX eMRAM technology, targeting edge AI and industrial applications. Intel continues to explore spintronic memory integration within its logic processes, aiming to enhance on-chip memory performance for data-centric workloads.

On the materials and equipment front, Applied Materials and Lam Research are providing advanced deposition and etching tools tailored for the precise fabrication of spintronic layers, such as magnetic tunnel junctions (MTJs). These companies are crucial in enabling the scalability and reliability of spintronic memory devices.

Startups and research-driven firms, such as Everspin Technologies and Crocus Technology, are pushing the boundaries of spintronic device performance, focusing on specialized markets like industrial automation and secure storage. Collaborative efforts between industry and academia, exemplified by partnerships with institutions like imec, are accelerating the transition from laboratory-scale prototypes to commercial products.

Overall, the competitive landscape in 2025 is marked by strategic alliances, intellectual property battles, and a focus on process innovation. The leading players are distinguished by their ability to integrate spintronic memory into mainstream semiconductor manufacturing, address yield and scalability challenges, and meet the stringent reliability requirements of emerging applications.

Market Growth Forecasts and CAGR Analysis (2025–2030)

The global spintronic memory device fabrication market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed, energy-efficient memory solutions in data centers, consumer electronics, and automotive applications. According to projections by MarketsandMarkets, the spintronics market—including memory device fabrication—is expected to register a compound annual growth rate (CAGR) of approximately 8.5% during this period. This growth is underpinned by the increasing adoption of magnetoresistive random-access memory (MRAM) and spin-transfer torque MRAM (STT-MRAM) technologies, which offer significant advantages over traditional memory devices in terms of speed, endurance, and power consumption.

Key industry players such as Samsung Electronics, Toshiba Corporation, and Intel Corporation are ramping up investments in spintronic memory device fabrication, with several pilot production lines expected to transition to mass production by 2026. The automotive sector, in particular, is anticipated to be a major growth driver, as advanced driver-assistance systems (ADAS) and autonomous vehicles require non-volatile, high-reliability memory solutions that spintronic devices can provide.

Regionally, Asia-Pacific is forecasted to maintain its dominance in the spintronic memory device fabrication market, accounting for over 45% of global revenues by 2030, according to International Data Corporation (IDC). This is attributed to the presence of leading semiconductor foundries and a robust electronics manufacturing ecosystem in countries such as South Korea, Japan, and China. North America and Europe are also expected to witness significant growth, fueled by research initiatives and strategic collaborations between technology firms and academic institutions.

- By 2030, the market size for spintronic memory device fabrication is projected to surpass USD 3.2 billion, up from an estimated USD 2.1 billion in 2025 (MarketsandMarkets).

- STT-MRAM is expected to be the fastest-growing segment, with a CAGR exceeding 10% during the forecast period, due to its scalability and compatibility with existing CMOS processes (Gartner).

Overall, the 2025–2030 outlook for spintronic memory device fabrication is characterized by accelerating innovation, expanding end-use applications, and a favorable investment climate, setting the stage for sustained market expansion.

Regional Market Analysis and Emerging Hubs

The regional landscape for spintronic memory device fabrication in 2025 is characterized by a dynamic interplay between established semiconductor powerhouses and rapidly emerging innovation hubs. Asia-Pacific continues to dominate the market, driven by robust investments in R&D, advanced manufacturing infrastructure, and the presence of leading foundries. Samsung Electronics and TSMC are at the forefront, leveraging their expertise in nanoscale fabrication to accelerate the commercialization of spin-transfer torque magnetic random-access memory (STT-MRAM) and related technologies. Japan, with companies like Toshiba and Renesas Electronics, remains a key player, particularly in the development of next-generation MRAM for embedded applications.

North America is witnessing significant momentum, propelled by strategic investments from both established semiconductor firms and innovative startups. The United States, in particular, benefits from a strong ecosystem of research institutions and government-backed initiatives, such as the National Science Foundation and U.S. Department of Energy, which are funding spintronics research and pilot fabrication lines. Companies like Intel and Everspin Technologies are scaling up production capabilities, focusing on high-density MRAM for data centers and automotive applications.

- Europe is emerging as a critical hub for spintronic device innovation, with the European Union’s Horizon Europe program supporting collaborative R&D across member states. Germany and France are leading in academic-industry partnerships, while the UK is fostering spintronic startups through university spinouts.

- China is rapidly scaling its capabilities, with state-backed investments and a focus on domestic supply chain resilience. Companies such as SMIC and Huawei are investing in spintronic memory research, aiming to reduce reliance on foreign IP and accelerate local production.

- Emerging Hubs include India and South Korea, where government incentives and partnerships with global technology leaders are fostering new fabrication facilities and research centers. South Korea, in particular, is leveraging its strengths in materials science and semiconductor manufacturing to attract foreign direct investment in spintronic device production.

Overall, the regional market for spintronic memory device fabrication in 2025 is marked by intense competition, cross-border collaborations, and a clear trend toward localization of advanced manufacturing capabilities. This evolving landscape is expected to drive both innovation and supply chain resilience in the global spintronics sector.

Challenges, Risks, and Opportunities in Spintronic Memory Device Fabrication

Spintronic memory device fabrication, particularly for technologies such as magnetic random-access memory (MRAM), faces a complex landscape of challenges, risks, and opportunities as the industry moves into 2025. The fabrication process involves integrating magnetic tunnel junctions (MTJs) and other spintronic structures onto semiconductor wafers, demanding high precision and compatibility with existing CMOS processes.

One of the primary challenges is achieving uniformity and scalability in the deposition of ultra-thin magnetic layers. Variations at the atomic scale can significantly impact device performance and yield. As device dimensions shrink below 20 nm, controlling interfacial roughness and minimizing defects becomes increasingly difficult, directly affecting tunnel magnetoresistance (TMR) ratios and data retention. Additionally, the integration of new materials, such as perpendicular magnetic anisotropy (PMA) layers and advanced spin-orbit coupling materials, introduces further complexity in process control and reliability testing Applied Materials.

Another significant risk is the thermal stability of spintronic devices during back-end-of-line (BEOL) processing. High-temperature steps can degrade magnetic properties, leading to data loss or device failure. This necessitates the development of low-temperature fabrication techniques and robust encapsulation methods. Furthermore, the sensitivity of spintronic devices to stray magnetic fields during manufacturing and operation poses additional reliability concerns, requiring advanced shielding and process monitoring solutions TSMC.

Despite these challenges, the opportunities in spintronic memory device fabrication are substantial. The non-volatility, high endurance, and fast switching speeds of MRAM and related devices position them as strong candidates for next-generation embedded and standalone memory solutions. The ability to integrate MRAM into standard CMOS flows opens pathways for in-memory computing and neuromorphic architectures, addressing the growing demand for energy-efficient, high-performance computing Gartner.

- Collaborations between equipment suppliers, foundries, and material science companies are accelerating process innovation and yield improvements.

- Emerging fabrication techniques, such as atomic layer deposition (ALD) and advanced etching, are enabling finer control over device structures.

- Government and industry investments in spintronics R&D are fostering a robust ecosystem for technology scaling and commercialization SEMI.

In summary, while spintronic memory device fabrication in 2025 is fraught with technical and operational risks, the potential rewards in terms of performance, scalability, and market impact are driving significant innovation and investment across the semiconductor value chain.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for spintronic memory device fabrication in 2025 is shaped by rapid technological advancements, evolving market demands, and strategic shifts among leading industry players. As the semiconductor industry faces the physical and economic limitations of traditional CMOS scaling, spintronic memory devices—such as magnetic random-access memory (MRAM) and spin-transfer torque MRAM (STT-MRAM)—are positioned to address critical needs for non-volatility, speed, and energy efficiency in next-generation computing systems.

Strategically, companies should prioritize investments in advanced materials and process integration. The development of high-quality magnetic tunnel junctions (MTJs) with optimized interfaces and low resistance-area products is essential for achieving high-density, low-power spintronic memories. Collaborative R&D efforts between foundries, materials suppliers, and equipment manufacturers will be crucial to overcoming fabrication challenges, such as variability in thin-film deposition and scalability to sub-20nm nodes. Leading players like Samsung Electronics and TSMC are already investing in pilot lines and process innovation to accelerate commercialization.

From an investment perspective, the market for spintronic memory devices is projected to grow at a CAGR exceeding 30% through 2028, driven by adoption in data centers, automotive electronics, and edge AI applications (MarketsandMarkets). Investors should monitor companies with strong intellectual property portfolios in spintronic device architectures and those forming strategic partnerships with major foundries or system integrators. Startups focusing on novel fabrication techniques—such as voltage-controlled magnetic anisotropy (VCMA) and perpendicular magnetic anisotropy (PMA)—are likely acquisition targets for established semiconductor firms seeking to expand their memory technology offerings.

- Strategic Recommendations:

- Accelerate R&D in scalable, CMOS-compatible spintronic fabrication processes.

- Form alliances with materials science innovators and equipment vendors to address yield and uniformity challenges.

- Target automotive and AI edge computing markets, where endurance and low latency are critical differentiators.

- Invest in workforce training for advanced nanofabrication and magnetics expertise.

- Investment Insights:

- Monitor public and private funding trends in spintronics, especially in the US, EU, and East Asia (SEMI).

- Evaluate companies with proven pilot-scale production and customer design wins in MRAM and related technologies.

- Consider the long-term potential of hybrid memory solutions integrating spintronic and conventional memory elements.

In summary, 2025 will be a pivotal year for spintronic memory device fabrication, with significant opportunities for strategic investment and innovation as the technology matures toward mainstream adoption.

Sources & References

- Toshiba Corporation

- Everspin Technologies

- MarketsandMarkets

- IBM Research

- Toshiba

- KLA Corporation

- Crocus Technology

- imec

- International Data Corporation (IDC)

- National Science Foundation

- Horizon Europe

- SMIC

- Huawei