Quantum Dot Terahertz Detectors in 2025: The Breakthrough Technology Set to Transform Imaging, Security, and Communications. Explore Market Acceleration, Disruptive Innovations, and Strategic Opportunities in the Next Five Years.

- Executive Summary: Key Findings & 2025 Outlook

- Market Overview: Defining Quantum Dot Terahertz Detectors

- Technology Landscape: Innovations, Materials, and Performance Benchmarks

- Market Size & Forecast (2025–2030): CAGR, Revenue, and Volume Projections

- Growth Drivers: Demand in Imaging, Security, and Wireless Communications

- Competitive Landscape: Leading Players, Startups, and Strategic Moves

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Challenges & Barriers: Technical, Regulatory, and Commercial Hurdles

- Future Outlook: Disruptive Trends, R&D Pipelines, and Commercialization Roadmap

- Strategic Recommendations: Investment, Partnerships, and Go-to-Market Strategies

- Sources & References

Executive Summary: Key Findings & 2025 Outlook

Quantum Dot Terahertz Detectors (QDTDs) are emerging as a transformative technology in the field of terahertz (THz) sensing, offering significant advantages in sensitivity, spectral selectivity, and operational temperature range compared to traditional bulk or quantum well-based detectors. In 2025, the QDTD market is poised for accelerated growth, driven by advancements in nanofabrication, increased demand for high-resolution imaging, and expanding applications in security, medical diagnostics, and wireless communications.

Key findings indicate that QDTDs are benefiting from ongoing research into novel quantum dot materials, such as III-V semiconductors and colloidal nanocrystals, which enable tunable detection across a broad THz spectrum. These innovations are being supported by major research institutions and industry leaders, including IBM and Samsung Electronics, who are investing in scalable manufacturing processes and device integration. Additionally, collaborations with organizations like the National Institute of Standards and Technology (NIST) are accelerating the development of standardized performance metrics and reliability testing protocols.

The 2025 outlook projects robust market expansion, particularly in sectors requiring non-invasive, high-speed imaging and spectroscopy. Security screening at airports and border checkpoints is expected to be a major driver, as QDTDs offer enhanced material discrimination and faster throughput compared to conventional millimeter-wave scanners. In healthcare, QDTDs are enabling new modalities for early cancer detection and real-time monitoring of biological processes, supported by initiatives from entities such as the National Institutes of Health (NIH). Furthermore, the integration of QDTDs into next-generation wireless communication systems is under exploration, with potential to support ultra-high bandwidth data transfer in the THz regime.

Despite these opportunities, challenges remain in terms of large-scale device uniformity, cost-effective production, and long-term stability. Industry stakeholders are addressing these issues through public-private partnerships and targeted funding programs, such as those led by the Defense Advanced Research Projects Agency (DARPA). Overall, 2025 is set to be a pivotal year for QDTDs, with significant progress anticipated in both technological maturity and commercial adoption.

Market Overview: Defining Quantum Dot Terahertz Detectors

Quantum dot terahertz detectors represent a cutting-edge class of photodetectors that leverage the unique quantum confinement effects of semiconductor nanocrystals—known as quantum dots—to sense electromagnetic radiation in the terahertz (THz) frequency range (0.1–10 THz). These devices are gaining significant attention due to their potential for high sensitivity, tunable spectral response, and operation at higher temperatures compared to traditional terahertz detectors. The terahertz region, situated between microwave and infrared on the electromagnetic spectrum, is of particular interest for applications in security screening, non-destructive testing, medical imaging, and high-speed wireless communications.

The market for quantum dot terahertz detectors is still in its nascent stage but is poised for rapid growth as advancements in nanofabrication and material science continue to improve device performance and scalability. Unlike conventional terahertz detectors, which often require cryogenic cooling and are limited by material constraints, quantum dot-based devices can be engineered for room-temperature operation and tailored spectral sensitivity. This flexibility is driving research and development efforts among leading academic institutions and technology companies worldwide.

Key players in the broader quantum dot and terahertz technology sectors, such as Samsung Electronics Co., Ltd., Sony Group Corporation, and Nanoco Group plc, are actively exploring quantum dot integration for advanced optoelectronic applications. Meanwhile, organizations like the National Institute of Standards and Technology (NIST) and the Optica (formerly OSA) are supporting research initiatives and standardization efforts in terahertz science and technology.

The market outlook for 2025 suggests increasing adoption of quantum dot terahertz detectors in specialized sectors, particularly where compact, sensitive, and cost-effective solutions are required. Ongoing collaborations between research institutions and industry are expected to accelerate commercialization, with a focus on improving device integration, reliability, and mass production capabilities. As the technology matures, quantum dot terahertz detectors are anticipated to play a pivotal role in expanding the practical use of terahertz imaging and sensing across diverse industries.

Technology Landscape: Innovations, Materials, and Performance Benchmarks

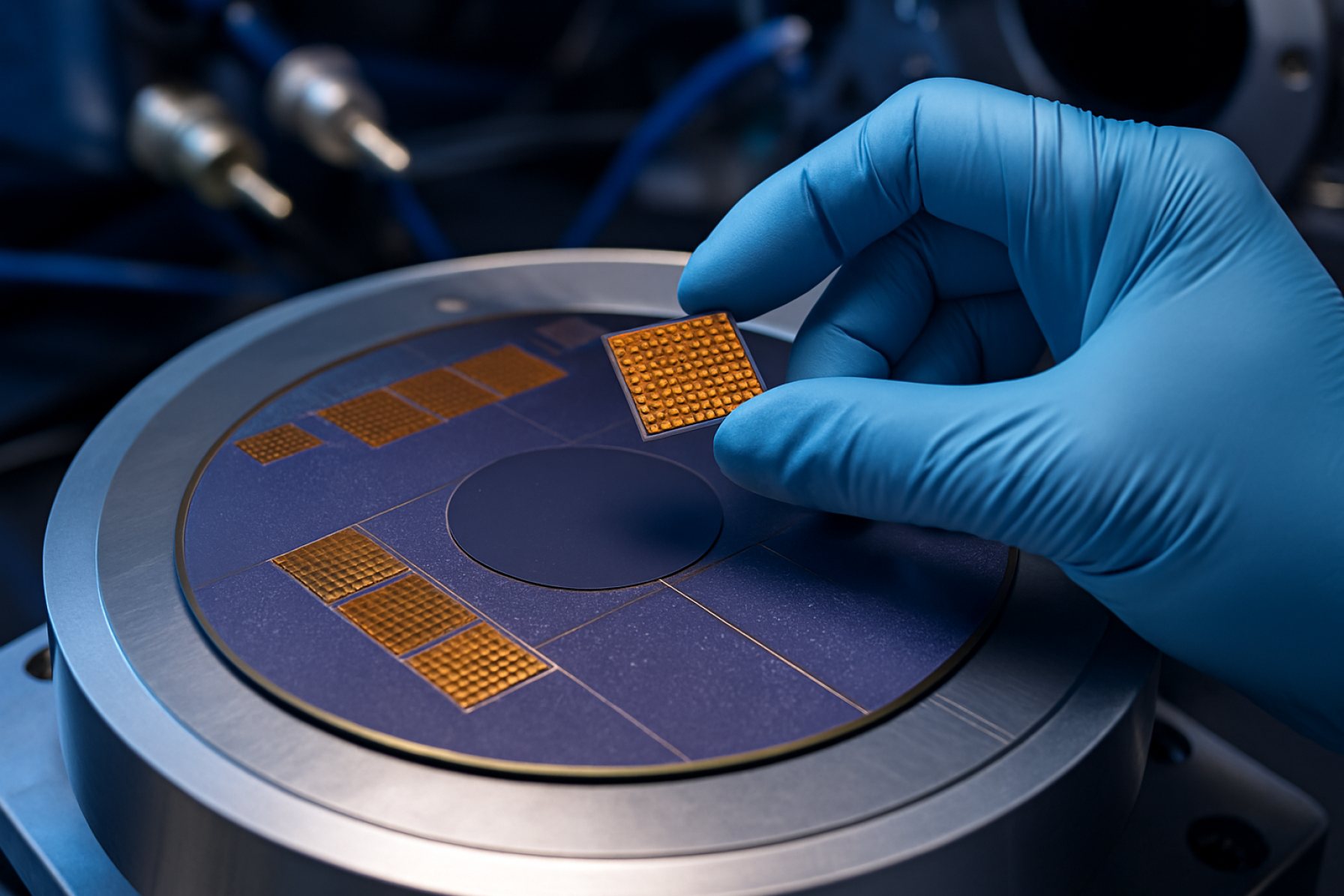

Quantum dot terahertz (THz) detectors represent a rapidly evolving frontier in photodetection technology, leveraging the unique quantum confinement effects of semiconductor nanocrystals to achieve high sensitivity and tunability in the terahertz frequency range. Recent innovations have focused on optimizing the synthesis of quantum dots (QDs), such as lead selenide (PbSe), mercury telluride (HgTe), and indium arsenide (InAs), to tailor their energy bandgaps for efficient THz absorption. Advances in colloidal synthesis techniques have enabled precise control over QD size and surface chemistry, directly impacting detector responsivity and noise characteristics.

Material integration remains a critical area of development. Hybrid architectures combining QDs with two-dimensional materials like graphene or transition metal dichalcogenides (TMDs) have demonstrated enhanced carrier mobility and reduced dark current, addressing longstanding performance bottlenecks. For instance, the integration of QDs with graphene field-effect transistors has yielded devices with room-temperature operation and improved signal-to-noise ratios, a significant milestone for practical THz imaging and spectroscopy applications.

Performance benchmarks for quantum dot THz detectors are typically evaluated in terms of responsivity (A/W), noise equivalent power (NEP), and detectivity (Jones). Recent prototypes have achieved responsivities exceeding 1 A/W and NEP values below 10-11 W/Hz1/2 at room temperature, rivaling or surpassing traditional bulk semiconductor detectors. These improvements are attributed to advances in QD surface passivation and ligand engineering, which minimize trap states and facilitate efficient charge extraction.

In 2025, research and development efforts are increasingly collaborative, with organizations such as National Institute of Standards and Technology (NIST) and imec spearheading standardization of measurement protocols and benchmarking methodologies. Industry players, including Samsung Electronics Co., Ltd. and Sony Group Corporation, are exploring scalable fabrication techniques for QD-based THz arrays, aiming to integrate these detectors into next-generation imaging systems and wireless communication devices.

Looking ahead, the technology landscape for quantum dot THz detectors is poised for further breakthroughs in material engineering, device architecture, and system integration. The convergence of nanomaterial innovation and advanced electronics is expected to unlock new applications in security screening, biomedical imaging, and high-speed wireless communications, solidifying the role of quantum dot THz detectors as a cornerstone of future photonic technologies.

Market Size & Forecast (2025–2030): CAGR, Revenue, and Volume Projections

The global market for quantum dot terahertz detectors is poised for significant growth between 2025 and 2030, driven by advancements in quantum dot technology, expanding applications in security screening, medical imaging, and non-destructive testing, and increasing investments in terahertz research. According to industry analyses, the market is expected to register a compound annual growth rate (CAGR) of approximately 18–22% during this period, reflecting robust demand across North America, Europe, and Asia-Pacific.

Revenue projections indicate that the market, valued at an estimated USD 120–150 million in 2025, could surpass USD 330–400 million by 2030. This growth is underpinned by the superior sensitivity, tunability, and miniaturization potential of quantum dot-based terahertz detectors compared to traditional semiconductor counterparts. The volume of units shipped is also anticipated to rise sharply, with annual shipments projected to increase from around 25,000 units in 2025 to over 70,000 units by 2030, as adoption accelerates in both research and commercial sectors.

Key drivers include ongoing R&D initiatives by leading institutions and companies such as Samsung Electronics Co., Ltd., Sony Group Corporation, and Toshiba Corporation, which are actively exploring quantum dot integration for next-generation sensing devices. Additionally, government-backed programs in the US, EU, and China are fostering innovation and commercialization of terahertz technologies, further propelling market expansion.

The market outlook is also shaped by the growing need for high-resolution, non-invasive imaging in healthcare and the increasing deployment of terahertz systems in airport security and industrial inspection. As manufacturing processes mature and costs decline, quantum dot terahertz detectors are expected to become more accessible to a broader range of end-users, supporting sustained market growth through 2030.

Growth Drivers: Demand in Imaging, Security, and Wireless Communications

The growth of quantum dot terahertz (THz) detectors is being propelled by surging demand across several high-impact sectors, notably imaging, security, and wireless communications. In imaging, quantum dot THz detectors offer superior sensitivity and spectral selectivity, enabling advanced applications in medical diagnostics, non-destructive testing, and material characterization. Their ability to operate at room temperature and be integrated into compact, portable devices is particularly attractive for medical imaging and industrial inspection, where traditional THz detectors often require complex cooling systems and bulky setups. Companies such as Samsung Electronics Co., Ltd. and Sony Group Corporation are actively exploring quantum dot-based sensors for next-generation imaging solutions.

In the security sector, the unique properties of quantum dot THz detectors—such as high sensitivity to concealed objects and non-ionizing radiation—make them ideal for security screening at airports, border checkpoints, and public venues. These detectors can identify hidden weapons, explosives, and contraband without physical contact or harmful radiation exposure, addressing growing global concerns over safety and privacy. Organizations like Smiths Detection Group Ltd. are investing in THz technologies to enhance security infrastructure.

Wireless communications represent another significant growth driver. The push toward 6G and beyond is intensifying research into THz frequencies for ultra-high-speed data transmission. Quantum dot THz detectors, with their fast response times and tunable detection ranges, are poised to play a crucial role in future wireless networks, supporting applications such as ultra-broadband connectivity, real-time data streaming, and secure communications. Industry leaders including Nokia Corporation and Telefonaktiebolaget LM Ericsson are actively developing THz components for next-generation wireless infrastructure.

The convergence of these drivers is further supported by ongoing advancements in quantum dot synthesis, device fabrication, and integration with silicon-based electronics. As a result, the market for quantum dot THz detectors is expected to expand rapidly through 2025, with innovation in imaging, security, and wireless communications at the forefront of this growth.

Competitive Landscape: Leading Players, Startups, and Strategic Moves

The competitive landscape for quantum dot terahertz (THz) detectors in 2025 is characterized by a dynamic mix of established technology leaders, innovative startups, and strategic collaborations. Major players in the semiconductor and photonics industries are investing heavily in quantum dot-based THz detection technologies, aiming to address the growing demand in applications such as security screening, medical imaging, and wireless communications.

Among the leading companies, Samsung Electronics Co., Ltd. and Sony Group Corporation have expanded their research and development efforts in quantum dot photodetectors, leveraging their expertise in nanomaterials and optoelectronics. These firms are focusing on integrating quantum dot THz detectors into next-generation imaging systems and consumer electronics, seeking to enhance sensitivity and spectral range.

In the United States, Northrop Grumman Corporation and Lockheed Martin Corporation are exploring quantum dot THz technologies for defense and aerospace applications, particularly in non-invasive inspection and secure communications. Their strategic moves include partnerships with leading research universities and government laboratories to accelerate the commercialization of advanced THz sensors.

Startups are also playing a pivotal role in shaping the market. Companies such as Quantum Solutions and QuantuMDx Group Limited are developing proprietary quantum dot synthesis methods and device architectures, aiming to achieve higher detection efficiency and lower production costs. These startups often collaborate with academic institutions and participate in government-funded innovation programs to validate their technologies and scale up manufacturing.

Strategic alliances and licensing agreements are increasingly common, as established players seek to access novel quantum dot materials and device designs developed by startups and research institutes. For example, BASF SE has entered into joint development agreements with nanotechnology firms to optimize quantum dot formulations for THz detection.

Overall, the competitive landscape in 2025 is marked by rapid technological advancements, cross-sector partnerships, and a race to achieve commercial viability for quantum dot THz detectors. The interplay between established corporations, agile startups, and research organizations is expected to drive further innovation and market growth in the coming years.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The regional landscape for quantum dot terahertz (THz) detectors in 2025 is shaped by varying levels of research intensity, industrial adoption, and government support across North America, Europe, Asia-Pacific, and emerging markets. Each region demonstrates unique strengths and challenges in the commercialization and deployment of these advanced photodetectors.

North America remains a leader in quantum dot THz detector innovation, driven by robust funding for quantum technologies and a strong ecosystem of academic and industrial collaboration. The United States, in particular, benefits from initiatives led by agencies such as the National Science Foundation and the U.S. Department of Energy, which support both fundamental research and early-stage commercialization. The presence of major semiconductor and photonics companies accelerates the translation of laboratory advances into practical devices for security screening, medical imaging, and wireless communications.

Europe is characterized by coordinated research efforts and cross-border collaborations, often supported by the European Commission through programs like Horizon Europe. Countries such as Germany, the United Kingdom, and France have established research centers focused on quantum materials and THz technologies. European industry is increasingly integrating quantum dot THz detectors into applications such as non-destructive testing and environmental monitoring, leveraging the region’s strong manufacturing base and regulatory frameworks.

Asia-Pacific is experiencing rapid growth, with China, Japan, and South Korea investing heavily in quantum technology infrastructure. China’s government-backed initiatives, such as those from the Ministry of Science and Technology of the People’s Republic of China, are fostering domestic innovation and scaling up production capabilities. Japanese and South Korean companies are focusing on miniaturization and integration of THz detectors into consumer electronics and automotive safety systems, reflecting the region’s emphasis on applied research and commercialization.

Emerging markets in regions such as the Middle East, Latin America, and parts of Southeast Asia are at an earlier stage of adoption. However, increasing awareness of the potential of THz technologies for security, healthcare, and industrial inspection is prompting governments and universities to initiate pilot projects and international collaborations. These regions are expected to benefit from technology transfer and capacity-building partnerships with established players in North America, Europe, and Asia-Pacific.

Challenges & Barriers: Technical, Regulatory, and Commercial Hurdles

Quantum dot terahertz (THz) detectors hold significant promise for applications in imaging, spectroscopy, and communications, but their widespread adoption faces several technical, regulatory, and commercial challenges.

Technical Barriers: The primary technical hurdle lies in achieving high sensitivity and low noise at room temperature. Quantum dots, while offering tunable energy levels, often suffer from limited carrier mobility and increased recombination rates, which can degrade detector performance. Material uniformity and reproducibility remain problematic, as the synthesis of quantum dots with consistent size and composition is complex. Integration with existing semiconductor platforms, such as silicon, is also challenging due to lattice mismatch and interface defects. Furthermore, scaling up from laboratory prototypes to large-area, manufacturable arrays without compromising performance is an ongoing issue for research and development teams at institutions like National Institute of Standards and Technology (NIST) and imec.

Regulatory Hurdles: The use of certain quantum dot materials, particularly those containing heavy metals like cadmium or lead, is subject to strict environmental and safety regulations. The European Commission restricts hazardous substances in electronic equipment under the RoHS Directive, which can limit the choice of materials for commercial products. Additionally, THz radiation itself is regulated in some jurisdictions due to concerns about interference with existing communication bands and potential health effects, requiring compliance with standards set by bodies such as the Federal Communications Commission (FCC).

Commercialization Challenges: From a business perspective, the cost of quantum dot synthesis and device fabrication remains high compared to established THz detection technologies, such as Schottky diodes or bolometers. The lack of standardized manufacturing processes and supply chains for quantum dot materials further complicates commercialization. Market adoption is also hindered by the need for robust, long-term reliability data and the integration of detectors into user-friendly systems. Companies like Hamamatsu Photonics K.K. and Trion Technology, Inc. are actively working to address these issues, but widespread deployment will require further advances in both technology and regulatory compliance.

Future Outlook: Disruptive Trends, R&D Pipelines, and Commercialization Roadmap

The future outlook for quantum dot terahertz (THz) detectors is shaped by a convergence of disruptive technological trends, robust research and development (R&D) pipelines, and evolving commercialization strategies. As the demand for high-sensitivity, room-temperature THz detection grows across sectors such as security screening, medical imaging, and wireless communications, quantum dot-based devices are positioned to address key limitations of traditional semiconductor detectors.

One of the most significant disruptive trends is the integration of quantum dots with advanced materials, such as graphene and other two-dimensional (2D) materials, to enhance carrier mobility and responsivity. Research groups and industry leaders are exploring hybrid architectures that leverage the tunable bandgap and strong quantum confinement of quantum dots, enabling detection at specific THz frequencies with improved signal-to-noise ratios. For instance, collaborative projects at institutions like University of Oxford and Massachusetts Institute of Technology are pushing the boundaries of device miniaturization and spectral selectivity.

The R&D pipeline is also witnessing a shift toward scalable fabrication techniques, such as solution-processed quantum dot films and inkjet printing, which promise to reduce manufacturing costs and facilitate integration with flexible substrates. Companies like Samsung Electronics Co., Ltd. and Sony Group Corporation are investing in pilot lines for quantum dot-based optoelectronic devices, signaling a move from laboratory prototypes to pre-commercial products.

On the commercialization roadmap, the next few years are expected to see the emergence of quantum dot THz detectors in niche markets, such as non-destructive testing and quality control in manufacturing. Strategic partnerships between quantum dot material suppliers and system integrators are accelerating the development of application-specific modules. Regulatory and standardization efforts, led by organizations like the Institute of Electrical and Electronics Engineers (IEEE), are also laying the groundwork for broader adoption by establishing performance benchmarks and interoperability guidelines.

Looking ahead to 2025 and beyond, the field is poised for rapid growth as advances in quantum dot synthesis, device engineering, and system integration converge. The commercialization of robust, cost-effective quantum dot THz detectors will likely catalyze new applications and drive the expansion of the global THz technology market.

Strategic Recommendations: Investment, Partnerships, and Go-to-Market Strategies

Strategic positioning in the quantum dot terahertz (THz) detector market requires a multifaceted approach, integrating targeted investments, collaborative partnerships, and robust go-to-market strategies. As the demand for high-sensitivity, room-temperature THz detection grows across sectors such as security screening, medical imaging, and wireless communications, stakeholders must align their strategies with both technological advancements and market needs.

Investment Priorities: Companies should prioritize R&D funding to advance quantum dot material synthesis, device integration, and scalable manufacturing. Investment in pilot production lines and cleanroom facilities can accelerate the transition from laboratory prototypes to commercial products. Additionally, securing intellectual property through patents and licensing agreements is crucial for long-term competitiveness. Public-private partnerships and grant opportunities from organizations like the National Science Foundation and the European Commission can supplement internal R&D budgets and foster innovation.

Partnerships and Ecosystem Development: Strategic alliances with academic institutions, national laboratories, and established semiconductor manufacturers can expedite technology validation and scale-up. Collaborations with end-users in target industries—such as healthcare providers, security agencies, and telecom operators—enable co-development of application-specific solutions and early adoption. Engaging with industry consortia, such as the Semiconductor Industry Association, can provide access to shared resources, standards development, and policy advocacy.

Go-to-Market Strategies: A phased market entry, beginning with niche, high-value applications (e.g., non-invasive medical diagnostics or advanced spectroscopy), allows for early revenue generation and technology refinement. Building a robust value proposition—emphasizing superior sensitivity, room-temperature operation, and integration flexibility—will differentiate quantum dot THz detectors from incumbent technologies. Establishing demonstration projects and pilot programs with key customers can validate performance claims and build market credibility. Leveraging digital marketing, participation in industry conferences, and publishing in peer-reviewed journals will further enhance visibility and thought leadership.

In summary, success in the quantum dot THz detector market hinges on sustained investment in innovation, strategic partnerships across the value chain, and a focused, application-driven go-to-market approach. By aligning these elements, companies can capture emerging opportunities and establish leadership in this rapidly evolving field.

Sources & References

- IBM

- National Institute of Standards and Technology (NIST)

- National Institutes of Health (NIH)

- Defense Advanced Research Projects Agency (DARPA)

- imec

- Toshiba Corporation

- Smiths Detection Group Ltd.

- Nokia Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Quantum Solutions

- QuantuMDx Group Limited

- BASF SE

- National Science Foundation

- European Commission

- Ministry of Science and Technology of the People’s Republic of China

- Hamamatsu Photonics K.K.

- Trion Technology, Inc.

- University of Oxford

- Massachusetts Institute of Technology

- Institute of Electrical and Electronics Engineers (IEEE)

- Semiconductor Industry Association