Liquid Biopsy Microfluidics in 2025: Unleashing a New Era of Non-Invasive Cancer Detection and Real-Time Disease Monitoring. Explore the Breakthroughs, Market Surge, and Future Roadmap Shaping Precision Medicine.

- Executive Summary: Key Insights & Market Highlights for 2025

- Market Overview: Defining Liquid Biopsy Microfluidics and Its Clinical Impact

- Market Size & Forecast (2025–2030): Growth Drivers, Trends, and CAGR Analysis (Estimated CAGR: 18–22%)

- Competitive Landscape: Leading Players, Startups, and Strategic Alliances

- Technology Deep Dive: Microfluidic Platforms, Innovations, and Integration with AI

- Applications: Oncology, Prenatal Testing, Infectious Diseases, and Beyond

- Regulatory Environment & Reimbursement Trends

- Challenges & Barriers: Technical, Clinical, and Commercial Hurdles

- Future Outlook: Emerging Opportunities, Investment Hotspots, and Next-Gen Solutions

- Appendix: Methodology, Data Sources, and Glossary

- Sources & References

Executive Summary: Key Insights & Market Highlights for 2025

The liquid biopsy microfluidics market is poised for significant growth in 2025, driven by advances in non-invasive cancer diagnostics, personalized medicine, and the integration of microfluidic technologies into clinical workflows. Liquid biopsy, which analyzes biomarkers such as circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes from blood samples, is increasingly favored for its minimal invasiveness and potential for early disease detection. Microfluidic platforms enhance the sensitivity, specificity, and throughput of these assays, enabling rapid and cost-effective analysis compared to traditional tissue biopsies.

Key insights for 2025 indicate a surge in adoption across oncology, with expanding applications in prenatal testing, transplant monitoring, and infectious disease diagnostics. The market is witnessing robust investment from both established diagnostics companies and innovative startups, with a focus on developing integrated, user-friendly devices suitable for point-of-care settings. Notable industry leaders such as Standard BioTools Inc. (formerly Fluidigm), Bio-Rad Laboratories, Inc., and Thermo Fisher Scientific Inc. are advancing microfluidic-based liquid biopsy platforms, while collaborations with academic institutions and healthcare providers are accelerating clinical validation and regulatory approvals.

Technological advancements in microfluidic chip design, automation, and multiplexing capabilities are reducing sample processing times and improving analytical performance. The integration of artificial intelligence and machine learning for data interpretation is further enhancing diagnostic accuracy and enabling real-time clinical decision-making. Regulatory agencies, including the U.S. Food and Drug Administration (FDA), are providing clearer pathways for the approval of liquid biopsy devices, fostering greater confidence among clinicians and patients.

Despite these advances, challenges remain in standardization, reimbursement, and large-scale clinical adoption. However, the overall outlook for 2025 is optimistic, with the liquid biopsy microfluidics market expected to experience double-digit growth, driven by increasing demand for early cancer detection, monitoring of treatment response, and the shift toward precision medicine. Strategic partnerships, continued R&D investment, and expanding clinical evidence will be critical in shaping the competitive landscape and unlocking the full potential of microfluidic liquid biopsy technologies in the coming year.

Market Overview: Defining Liquid Biopsy Microfluidics and Its Clinical Impact

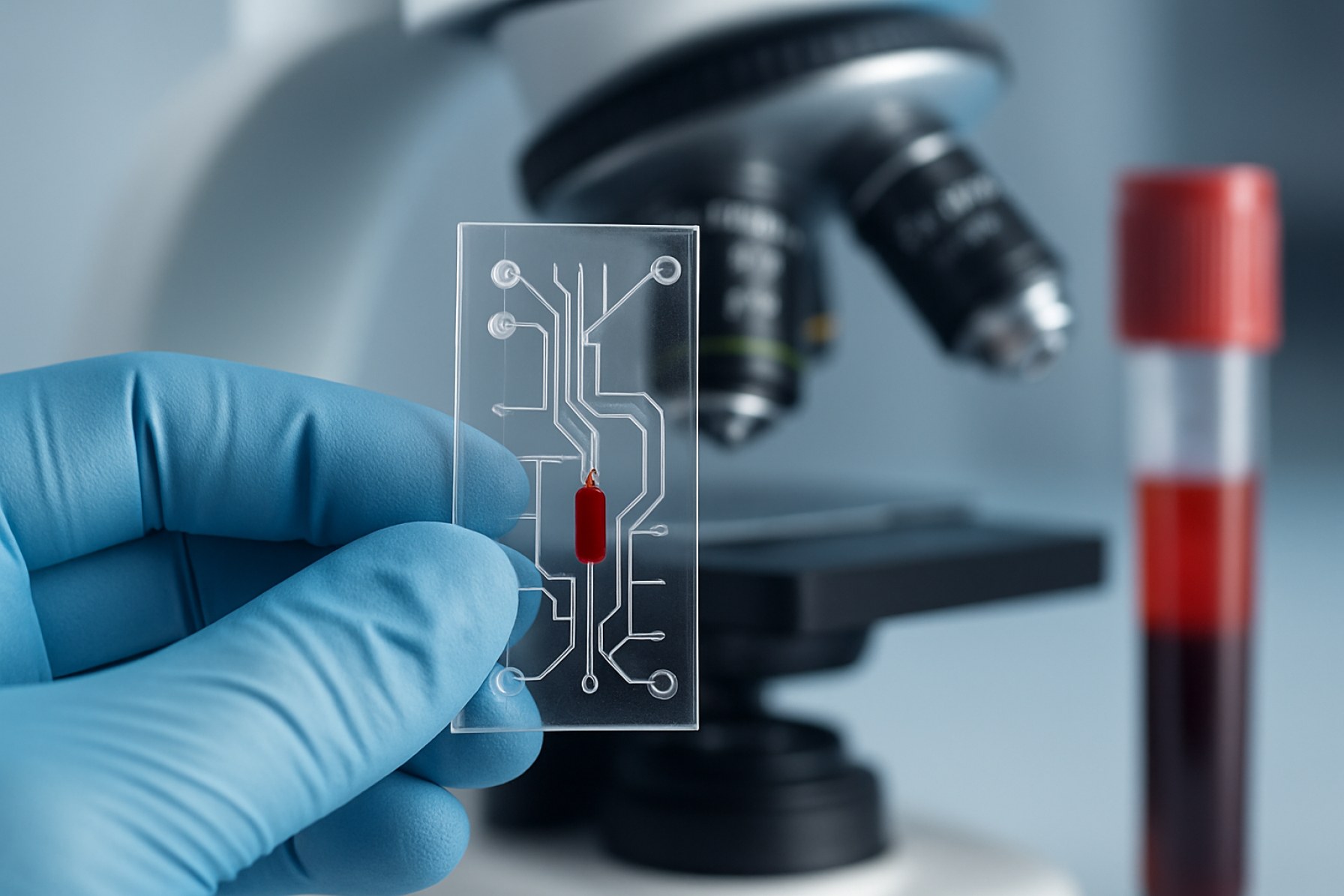

Liquid biopsy microfluidics refers to the integration of microfluidic technologies into liquid biopsy platforms, enabling the analysis of biomarkers such as circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes from blood and other bodily fluids. Unlike traditional tissue biopsies, liquid biopsies are minimally invasive and can be performed repeatedly, offering real-time insights into disease progression and therapeutic response. Microfluidic systems, which manipulate small volumes of fluids within microscale channels, have revolutionized the sensitivity, speed, and scalability of liquid biopsy assays.

The clinical impact of liquid biopsy microfluidics is profound, particularly in oncology. These platforms facilitate early cancer detection, monitoring of minimal residual disease, and identification of emerging drug resistance, all with a simple blood draw. Microfluidic devices can efficiently isolate rare CTCs or nucleic acids from complex biological samples, overcoming challenges of low analyte abundance and high background noise. This precision is critical for personalized medicine, where timely and accurate molecular profiling guides targeted therapies.

Recent years have seen significant advancements in the commercialization and clinical adoption of microfluidic-based liquid biopsy solutions. Companies such as Fluxion Biosciences, Inc. and Menarini Silicon Biosystems S.p.A. have developed platforms that automate and standardize the isolation and analysis of CTCs, making these technologies more accessible to clinical laboratories. Furthermore, organizations like U.S. Food and Drug Administration (FDA) are increasingly providing regulatory guidance for the validation and approval of liquid biopsy devices, accelerating their integration into routine clinical practice.

The market for liquid biopsy microfluidics is expanding rapidly, driven by the growing demand for non-invasive diagnostic tools, the rising incidence of cancer, and the need for longitudinal patient monitoring. As microfluidic technologies continue to evolve, they are expected to further enhance the analytical performance, reduce costs, and broaden the clinical utility of liquid biopsies across oncology and other disease areas. The convergence of microfluidics with next-generation sequencing and digital PCR is poised to unlock new possibilities in precision diagnostics and personalized healthcare.

Market Size & Forecast (2025–2030): Growth Drivers, Trends, and CAGR Analysis (Estimated CAGR: 18–22%)

The global market for liquid biopsy microfluidics is poised for robust expansion between 2025 and 2030, with an estimated compound annual growth rate (CAGR) of 18–22%. This growth is driven by the increasing adoption of minimally invasive diagnostic techniques, rising cancer incidence, and ongoing technological advancements in microfluidic platforms. Liquid biopsy microfluidics enables the efficient isolation and analysis of circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes from blood samples, offering a less invasive alternative to traditional tissue biopsies.

Key growth drivers include the growing demand for early cancer detection and monitoring, as well as the expanding applications of liquid biopsy in personalized medicine. The integration of microfluidic technologies has significantly improved the sensitivity, specificity, and throughput of liquid biopsy assays, making them more attractive for clinical and research use. Additionally, the increasing investments by major healthcare companies and research institutions in microfluidics-based diagnostics are accelerating product development and commercialization. For instance, Standard BioTools Inc. (formerly Fluidigm) and Bio-Rad Laboratories, Inc. are actively advancing microfluidic solutions for liquid biopsy applications.

Emerging trends shaping the market include the integration of artificial intelligence (AI) and machine learning algorithms with microfluidic platforms to enhance data analysis and interpretation. There is also a notable shift toward the development of point-of-care (POC) liquid biopsy devices, which promise rapid and decentralized testing capabilities. Furthermore, collaborations between diagnostic companies and pharmaceutical firms are fostering the development of companion diagnostics, supporting the growth of precision oncology.

Regionally, North America and Europe are expected to maintain significant market shares due to strong healthcare infrastructure, supportive regulatory frameworks, and high R&D activity. However, the Asia-Pacific region is anticipated to witness the fastest growth, propelled by increasing healthcare investments, rising awareness of early cancer screening, and expanding access to advanced diagnostic technologies.

In summary, the liquid biopsy microfluidics market is set for dynamic growth through 2030, underpinned by technological innovation, expanding clinical applications, and a global push toward non-invasive, precision diagnostics. The estimated CAGR of 18–22% reflects the sector’s strong momentum and the transformative potential of microfluidic technologies in the future of cancer care.

Competitive Landscape: Leading Players, Startups, and Strategic Alliances

The competitive landscape of liquid biopsy microfluidics in 2025 is characterized by a dynamic mix of established diagnostics companies, innovative startups, and a growing number of strategic alliances. Major industry leaders such as Standard BioTools Inc. (formerly Fluidigm), Bio-Rad Laboratories, Inc., and Thermo Fisher Scientific Inc. continue to drive advancements in microfluidic platforms for circulating tumor cell (CTC) isolation, cell-free DNA (cfDNA) analysis, and exosome profiling. These companies leverage robust R&D pipelines and global distribution networks to maintain their competitive edge.

Startups are playing a pivotal role in shaping the future of liquid biopsy microfluidics. Companies such as Clearbridge BioMedics and Microsurfaces, Inc. are developing next-generation microfluidic chips and integrated systems that offer higher sensitivity, automation, and scalability. Their focus on user-friendly, point-of-care solutions is accelerating the adoption of liquid biopsy in clinical and research settings.

Strategic alliances and collaborations are increasingly common, as companies seek to combine complementary technologies and expand their market reach. For example, Thermo Fisher Scientific Inc. has entered into partnerships with academic institutions and biotech firms to co-develop microfluidic-based assays for early cancer detection and monitoring. Similarly, Bio-Rad Laboratories, Inc. collaborates with pharmaceutical companies to integrate its droplet digital PCR (ddPCR) technology into clinical trial workflows.

Industry consortia and public-private partnerships are also fostering innovation. Initiatives led by organizations such as the National Cancer Institute and the National Institutes of Health support translational research and standardization efforts, helping to address regulatory and technical challenges in the field.

Overall, the competitive landscape in 2025 is marked by rapid technological evolution, with established players consolidating their positions through innovation and partnerships, while agile startups introduce disruptive solutions. Strategic alliances are expected to intensify, as stakeholders recognize the value of collaboration in accelerating the clinical adoption of liquid biopsy microfluidics.

Technology Deep Dive: Microfluidic Platforms, Innovations, and Integration with AI

Microfluidic platforms have emerged as a transformative technology in the field of liquid biopsy, enabling the precise manipulation and analysis of minute biological samples such as blood, plasma, or serum. These platforms utilize networks of microscale channels and chambers to isolate, enrich, and analyze rare biomarkers, including circulating tumor cells (CTCs), cell-free DNA (cfDNA), and extracellular vesicles, with high sensitivity and specificity. Recent innovations in microfluidic device design have focused on enhancing throughput, reducing sample loss, and improving the capture efficiency of target analytes. For instance, advances in inertial microfluidics and deterministic lateral displacement have enabled label-free separation of CTCs based on size and deformability, while immunoaffinity-based microfluidic chips leverage surface-bound antibodies for highly selective capture of tumor-derived components.

Integration with artificial intelligence (AI) is accelerating the capabilities of microfluidic liquid biopsy platforms. AI-driven image analysis algorithms are now routinely applied to microfluidic-captured CTCs, automating the identification and classification of rare cells with greater accuracy than manual methods. Machine learning models are also being used to interpret complex multi-omic data generated from microfluidic assays, facilitating the discovery of novel biomarkers and improving diagnostic performance. Furthermore, AI is streamlining the design and optimization of microfluidic devices themselves, using predictive modeling to simulate fluid dynamics and cell behavior within microchannels, thereby reducing development time and cost.

The integration of microfluidics and AI is also paving the way for point-of-care (POC) liquid biopsy solutions. Compact, automated microfluidic systems equipped with embedded AI analytics are being developed for rapid, on-site cancer screening and monitoring, minimizing the need for centralized laboratory infrastructure. These advances are supported by collaborations between academic research centers, technology companies, and healthcare providers. For example, ibidi GmbH and Fluxion Biosciences, Inc. are among the companies pioneering microfluidic platforms for cell analysis, while Illumina, Inc. and Thermo Fisher Scientific Inc. are integrating AI-driven analytics into their genomics workflows.

Looking ahead to 2025, the convergence of microfluidics and AI is expected to further democratize access to liquid biopsy, enabling earlier cancer detection, real-time treatment monitoring, and personalized therapeutic strategies. Continued innovation in device miniaturization, automation, and data analytics will be critical to realizing the full clinical potential of liquid biopsy microfluidics.

Applications: Oncology, Prenatal Testing, Infectious Diseases, and Beyond

Microfluidic technologies are revolutionizing the field of liquid biopsy by enabling the rapid, sensitive, and cost-effective analysis of biomarkers from blood and other bodily fluids. In oncology, microfluidic-based liquid biopsy platforms are being used to isolate and analyze circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes, providing critical information for early cancer detection, prognosis, and monitoring of treatment response. For example, microfluidic chips developed by Fluxion Biosciences, Inc. and Miltenyi Biotec B.V. & Co. KG allow for high-throughput and high-purity CTC capture, supporting personalized cancer management and real-time assessment of tumor evolution.

In prenatal testing, microfluidic liquid biopsy platforms facilitate the non-invasive analysis of fetal genetic material present in maternal blood. Companies such as Natera, Inc. and Illumina, Inc. have integrated microfluidic technologies into their workflows to improve the sensitivity and specificity of non-invasive prenatal testing (NIPT), enabling early detection of chromosomal abnormalities and genetic disorders without the risks associated with traditional invasive procedures.

The application of microfluidic liquid biopsy extends to infectious disease diagnostics, where rapid and multiplexed detection of pathogens is crucial. Microfluidic devices can isolate and analyze pathogen-derived nucleic acids or antigens from small sample volumes, supporting point-of-care testing and outbreak surveillance. For instance, bioMérieux S.A. and Cepheid have developed microfluidic-based platforms for the detection of viral and bacterial infections, including SARS-CoV-2, HIV, and tuberculosis, offering faster turnaround times and improved accessibility compared to conventional laboratory methods.

Beyond these established areas, microfluidic liquid biopsy is being explored for applications in organ transplantation (monitoring graft health via donor-derived cfDNA), autoimmune disease diagnostics, and neurological disorder research. The versatility and scalability of microfluidic systems, combined with advances in biomarker discovery and single-cell analysis, are expected to further expand their clinical utility in 2025 and beyond, driving the transition toward more personalized and minimally invasive diagnostics.

Regulatory Environment & Reimbursement Trends

The regulatory environment for liquid biopsy microfluidics is evolving rapidly as these technologies gain traction in clinical diagnostics and personalized medicine. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Commission are increasingly focused on establishing clear pathways for the approval and oversight of microfluidic-based liquid biopsy devices. In the United States, the FDA has issued guidance documents for in vitro diagnostic (IVD) devices, including those utilizing microfluidic platforms for circulating tumor DNA (ctDNA) and other biomarkers. The agency emphasizes analytical validity, clinical validity, and clinical utility, requiring robust evidence from clinical trials and real-world data to support claims of safety and effectiveness.

In Europe, the implementation of the In Vitro Diagnostic Regulation (IVDR) has introduced more stringent requirements for clinical evidence, performance evaluation, and post-market surveillance of liquid biopsy microfluidic devices. Manufacturers must now provide comprehensive technical documentation and demonstrate conformity with the new standards, which has led to increased collaboration with notified bodies and regulatory consultants. The European Medicines Agency (EMA) also plays a role in the assessment of companion diagnostics, which are often developed using microfluidic technologies.

Reimbursement trends are closely tied to regulatory approval and clinical adoption. In the U.S., the Centers for Medicare & Medicaid Services (CMS) has begun to recognize the value of liquid biopsy tests, particularly for oncology applications. Coverage decisions are increasingly based on demonstrated clinical utility, cost-effectiveness, and the ability to improve patient outcomes. Private insurers are following suit, but reimbursement remains variable depending on the specific test, indication, and supporting evidence. In Europe, national health systems are gradually incorporating liquid biopsy microfluidics into standard care pathways, but reimbursement policies differ widely between countries and are often subject to health technology assessments.

Looking ahead to 2025, the regulatory and reimbursement landscape for liquid biopsy microfluidics is expected to become more harmonized, with greater emphasis on real-world evidence, interoperability, and patient access. Stakeholders—including device manufacturers, healthcare providers, and payers—are collaborating to streamline approval processes and expand coverage, aiming to accelerate the integration of these innovative diagnostics into routine clinical practice.

Challenges & Barriers: Technical, Clinical, and Commercial Hurdles

Liquid biopsy microfluidics holds significant promise for non-invasive cancer diagnostics and monitoring, yet its widespread adoption faces several technical, clinical, and commercial challenges. Technically, the isolation and analysis of rare circulating biomarkers—such as circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes—demand highly sensitive and specific microfluidic platforms. Achieving consistent performance across different sample types and patient populations remains difficult due to biological variability and the low abundance of target analytes. Device clogging, sample loss, and the need for precise fluid control further complicate the engineering of robust, reproducible systems. Additionally, integrating downstream molecular analysis (e.g., PCR, sequencing) within microfluidic devices without compromising sensitivity or throughput is an ongoing hurdle for developers like Fluxion Biosciences, Inc. and Miltenyi Biotec B.V. & Co. KG.

Clinically, the translation of microfluidic liquid biopsy technologies into routine practice is hampered by a lack of standardized protocols and validation across large, diverse patient cohorts. Regulatory approval requires rigorous demonstration of clinical utility, analytical validity, and reproducibility, which is challenging given the heterogeneity of cancer and the evolving landscape of biomarker discovery. Furthermore, clinicians require clear guidelines on interpreting results and integrating them into existing diagnostic workflows. Organizations such as the U.S. Food and Drug Administration and Clinical and Laboratory Standards Institute are working to establish frameworks, but harmonization remains incomplete.

Commercially, the high cost of research, development, and manufacturing of microfluidic devices can limit scalability and market penetration. Startups and established companies alike must navigate complex intellectual property landscapes and secure significant investment to bring products to market. Reimbursement remains a major barrier, as payers require robust evidence of cost-effectiveness and clinical benefit before covering new tests. Additionally, competition from established diagnostic modalities and emerging technologies intensifies the pressure to demonstrate clear advantages in sensitivity, specificity, and ease of use. Companies such as Bio-Rad Laboratories, Inc. and Thermo Fisher Scientific Inc. are investing in overcoming these barriers, but widespread clinical adoption will depend on continued innovation and collaboration across the sector.

Future Outlook: Emerging Opportunities, Investment Hotspots, and Next-Gen Solutions

The future of liquid biopsy microfluidics is poised for significant transformation, driven by rapid technological advancements, expanding clinical applications, and increasing investment interest. As the demand for minimally invasive cancer diagnostics and real-time disease monitoring grows, microfluidic platforms are emerging as a cornerstone technology, offering high sensitivity, scalability, and cost-effectiveness. In 2025 and beyond, several key trends are shaping the landscape.

Emerging Opportunities: The integration of artificial intelligence (AI) and machine learning with microfluidic liquid biopsy platforms is expected to enhance data analysis, enabling more accurate detection of circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes. This convergence is opening new avenues for early cancer detection, therapy selection, and monitoring of treatment response. Additionally, the expansion of microfluidic applications beyond oncology—such as in prenatal testing, infectious disease diagnostics, and organ transplant monitoring—broadens the market potential and clinical impact.

Investment Hotspots: North America and Europe remain leading regions for investment, supported by robust healthcare infrastructure, strong research ecosystems, and favorable regulatory environments. However, Asia-Pacific is rapidly emerging as a hotspot, driven by increasing healthcare expenditure, government initiatives, and a growing biotechnology sector. Companies such as Fluxion Biosciences, Bio-Rad Laboratories, Inc., and Dolomite Microfluidics are at the forefront, attracting significant funding for the development and commercialization of next-generation microfluidic devices.

Next-Gen Solutions: The next wave of innovation focuses on fully integrated, point-of-care microfluidic systems capable of delivering rapid, multiplexed analyses from a single blood sample. Advances in materials science, such as the use of biocompatible polymers and 3D printing, are enabling the creation of more robust and customizable devices. Furthermore, partnerships between academic institutions, healthcare providers, and industry leaders—such as those fostered by National Institutes of Health (NIH) and National Cancer Institute (NCI)—are accelerating the translation of microfluidic liquid biopsy technologies from bench to bedside.

In summary, the outlook for liquid biopsy microfluidics in 2025 is marked by dynamic innovation, expanding clinical utility, and robust investment, positioning the field as a critical enabler of precision medicine and next-generation diagnostics.

Appendix: Methodology, Data Sources, and Glossary

This appendix outlines the methodology, data sources, and glossary relevant to the analysis of liquid biopsy microfluidics in 2025.

- Methodology: The research employed a mixed-methods approach, combining qualitative analysis of peer-reviewed scientific literature with quantitative data from industry reports and regulatory filings. Primary data was gathered through interviews with experts in microfluidics and oncology diagnostics, while secondary data was sourced from official company disclosures, product documentation, and regulatory agency databases. Market trends were analyzed using historical data and projections from leading industry stakeholders.

- Data Sources: Key data sources included official publications and product information from companies such as Standard BioTools Inc. (formerly Fluidigm), Bio-Rad Laboratories, Inc., and Thermo Fisher Scientific Inc.. Regulatory and clinical trial data were referenced from the U.S. Food and Drug Administration and the U.S. National Library of Medicine. Industry standards and guidelines were reviewed from organizations such as the International Organization for Standardization and the International Federation of Clinical Chemistry and Laboratory Medicine.

-

Glossary:

- Liquid Biopsy: A minimally invasive technique for detecting biomarkers in bodily fluids, primarily blood, to diagnose or monitor diseases such as cancer.

- Microfluidics: The science and technology of systems that process or manipulate small amounts of fluids, using channels with dimensions of tens to hundreds of micrometers.

- Circulating Tumor DNA (ctDNA): Fragments of DNA released into the bloodstream by tumor cells, often targeted in liquid biopsy assays.

- Exosomes: Small extracellular vesicles secreted by cells, containing proteins, lipids, and nucleic acids, and serving as potential biomarkers.

- Lab-on-a-Chip: A device integrating multiple laboratory functions on a single microfluidic chip for high-throughput analysis.

This structured approach ensures the reliability and relevance of the findings presented in the main report on liquid biopsy microfluidics.

Sources & References

- Thermo Fisher Scientific Inc.

- Clearbridge BioMedics

- National Cancer Institute

- National Institutes of Health

- Illumina, Inc.

- Miltenyi Biotec B.V. & Co. KG

- Natera, Inc.

- bioMérieux S.A.

- Cepheid

- European Commission

- European Medicines Agency (EMA)

- CMS

- Clinical and Laboratory Standards Institute

- Dolomite Microfluidics

- U.S. National Library of Medicine

- International Organization for Standardization

- International Federation of Clinical Chemistry and Laboratory Medicine