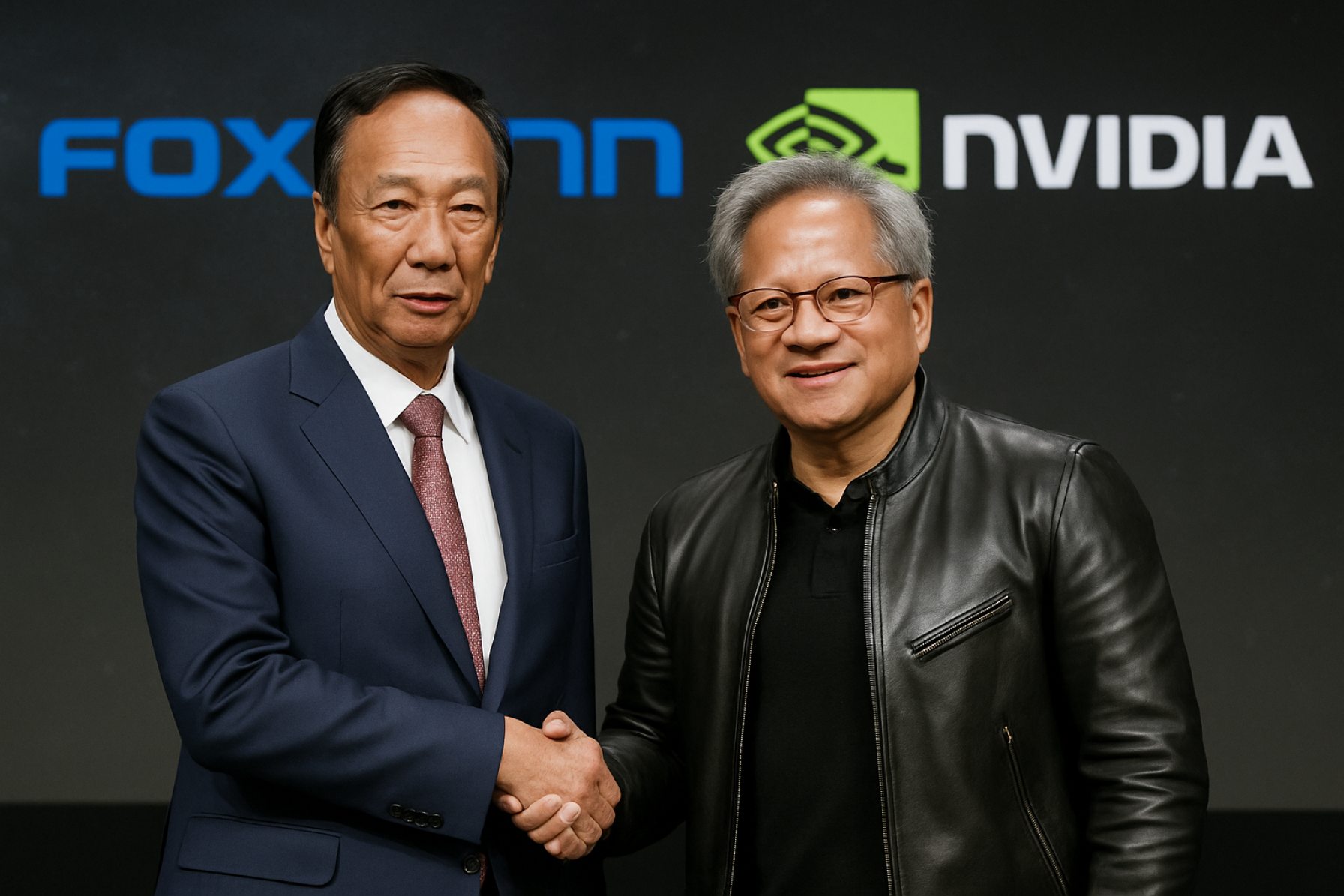

- Foxconn and Nvidia are partnering to build a massive artificial intelligence data center in Taiwan, signaling a revolution in AI infrastructure.

- Nvidia reported record data center revenue of $44.06 billion, despite a $4.5 billion write-down from U.S. export restrictions barring advanced AI chip sales to China.

- Geopolitical tensions are reshaping the global AI chip market, with supply chain shifts and fierce competition affecting American and Chinese tech leaders.

- Foxconn’s investment highlights that the AI race extends beyond the U.S., as nations worldwide treat artificial intelligence as vital for economic growth.

- Nvidia’s adaptive strategies and Foxconn’s pivot to AI signify a new era where artificial intelligence is becoming the bedrock of future industry and innovation.

Steel pincers in Taipei’s tech district grasp and lift, as Foxconn, the world’s electronics kingmaker, embarks on an audacious venture with Silicon Valley’s Nvidia. Together, they are laying the groundwork for an artificial intelligence powerhouse—a colossal data center in Taiwan, pulsing with the energy equivalent of a small city: 100 megawatts. Not merely a server farm, but a digital heart intended to propel Asia—and perhaps the world—into a new epoch of AI-driven innovation.

Against a backdrop of geopolitical tension, this alliance punctuates a turning point for the industry. Nvidia, riding high on a recent surge, reported record-breaking quarterly revenue of $44.06 billion from its sprawling data center business, marking a blistering 73% growth year-over-year. Yet, beneath the euphoria, complexity brews. A hefty $4.5 billion write-down—brought on by export restrictions blocking Nvidia’s advanced AI chips, the H20, from China—has reshaped the global chessboard. The Biden administration’s policies have effectively closed the $50 billion Chinese AI chip market to American companies, an event punctuated by shortages, supply chain recalibration, and shifting competitive advantage.

Still, Nvidia’s strategy has proven both resilient and resourceful. Some losses have been cushioned by cannily reusing materials, reflecting the relentless, adaptive rhythm of the semiconductor trade. With gross margins resting at 61%—which would have soared to over 71% without the export snag—Nvidia illustrates how success and headwind can dance in tandem.

Foxconn’s commitment, meanwhile, signals that the AI infrastructure boom is no American monopoly. The phased construction in Taiwan stands as a testament: around the globe, countries now treat artificial intelligence as indispensable as electricity or the internet, foundational to future economic might. Foxconn, already famed for assembling the world’s iPhones, is pivoting its prowess into this AI arena—a move likely to spark seismic changes in everything from cloud computing to smart manufacturing.

Markets responded with a thrill of anticipation, as Nvidia’s stock oscillated 4% to 5% higher after earnings—proof that investors see not short-term noise, but long-term revolution.

The takeaway: Nation-states and tech giants are staking their claims as AI becomes core infrastructure. The Foxconn-Nvidia pact not only redefines industrial partnerships but sets the pace in the global race for AI dominance. Amid restriction and rivalry, the pursuit of artificial intelligence moves forward—faster, smarter, and ever more entwined with the way modern people live and work. For those watching the horizon, the future of AI is not just being predicted; it is being fiercely built.

For up-to-date technology news and insights, keep an eye on the leaders at Foxconn and Nvidia.

Inside the Mega AI Revolution: Hidden Power Plays and Surprising Truths About the Foxconn-Nvidia Alliance

Unpacking the Foxconn-Nvidia Taiwan AI Data Center: Key Facts, Industry Insights, and What’s Next

The recently announced Foxconn and Nvidia partnership is much more than a strategic technology deal—it’s a landmark moment reshaping the global artificial intelligence landscape. If you’re following this development, here are extra facts, deep industry context, pressing Q&As, and actionable recommendations you won’t find in most headlines.

—

1. What Sets This AI Data Center Apart?

– 100 Megawatt Powerhouse: This center will rival the energy usage of small cities, placing it among Asia’s largest AI-focused facilities.

– Custom-Built for AI: Unlike traditional server farms, the facility will be optimized for GPU-intensive AI model training, big data analytics, and cloud-based inference.

– Location, Location, Location: Taipei’s tech district offers proximity to world-class hardware design, supply chain partners, and Taiwan’s sophisticated IT ecosystem.

—

2. Why Foxconn and Nvidia? The Strategic Edge

Foxconn’s Manufacturing Might

– From iPhones to AI: Foxconn builds 70% of the world’s iPhones (CNBC, 2022), and is now replicating its supply chain mastery for hyperscale AI infrastructure.

– Homegrown Resilience: By building in Taiwan—a key player in global semiconductor supply—Foxconn and Nvidia sidestep risks posed by U.S.–China technology tensions.

Nvidia’s Unmatched Silicon

– Nvidia’s H100 & Beyond: The world’s most advanced AI chips, especially the H100, power flagship models like OpenAI’s GPT-4, Google’s Gemini, and Meta’s Llama 3.

– Software Ecosystem: Nvidia’s CUDA platform and frameworks like TensorRT dominate enterprise AI development.

More about Nvidia: Nvidia

Deepen your knowledge about Foxconn: Foxconn

—

3. AI Infrastructure as Critical National Asset

– Sovereign Data: Governments are classifying AI data centers alongside utilities as “national critical infrastructure.” (World Economic Forum, 2023)

– Regulatory Firestorm: Countries now restrict exports of cutting-edge chips (see U.S. rules on AI semiconductors for China), causing ripple effects for tech giants.

—

4. Market Trends & Forecasts

Explosive Demand for Compute

– AI Market Growth: Global AI infrastructure spending is projected to surpass $130 billion by 2027, with hyperscale data centers leading the charge (IDC, 2024).

– Chip Shortages: Persistent scarcity of top-tier GPUs like Nvidia’s H100 has led to secondary market markups and supply delays of up to a year (The Information, 2023).

Asia Rising

– Local AI Giants: Companies in S. Korea, Japan, Singapore, and India are expected to follow suit, building advanced facilities and forging alliances with Nvidia, AMD, and Intel.

– Semiconductor Independence: Taiwan’s key role in chip manufacturing (home to TSMC) gives it unique leverage in the AI race.

—

5. Pressing Questions Answered

Q: Will this data center be sustainable?

A: Energy use is huge, but Foxconn has signaled plans for renewable energy sourcing and advanced cooling (e.g., liquid immersion), following industry best practices.

Q: Is China completely cut off from Nvidia’s best chips?

A: Not entirely—Nvidia has created downgraded chips (e.g., A800, H800) for China, but these underperform compared to exports to other markets due to U.S. restrictions.

Q: Who are the next biggest players?

A: AMD and Intel are pushing hard with their MI300 and Gaudi chips, but Nvidia controls over 80% of the high-end AI accelerator market as of early 2024 (Omdia).

Q: How much will companies pay for AI compute?

A: Renting top-tier GPUs (like H100) on public clouds can exceed $5 to $10 per GPU/hour (AWS, Azure pricing), with entire clusters costing tens of millions per year.

—

6. Features, Specs & Tech Innovations

– Liquid Cooling: Keeps power-hungry AI chips efficient and prevents thermal throttling.

– Software Integration: Expected full stack with Nvidia’s DGX systems, CUDA, and enterprise management dashboards.

– Data Security: Physical location in Taiwan brings advantages for companies wary of storing sensitive AI training data in U.S. or China-based centers.

—

7. Controversies, Limitations & Security

– Geopolitics: Rising cross-strait tensions present a long-term risk for operations based in Taiwan.

– Export Controls: U.S. rules can suddenly disrupt supply, requiring rapid business pivots.

– Environmental Footprint: High water and power needs highlight the climate challenge for AI at scale.

—

8. Real-World Use Cases & Life Hacks

How Businesses Can Benefit:

– Accelerate generative AI R&D: Faster access to powerful GPU clusters.

– Outsource smart manufacturing upgrades.

– Reduce latency for Asia-Pacific AI deployments.

– Leverage “sovereign cloud” infrastructure (data stays local).

How-To for Tech Leaders:

– Build for Resilience: Diversify cloud providers and geographies to reduce chip/cloud supplier risk.

– Optimize Workloads: Shift to mixed-precision computing and software optimizations to extend AI infrastructure ROI.

– Upgrade Security: Encrypt data in transit and at rest—especially in multinational scenarios.

—

9. Pros & Cons Overview

Pros:

– Unmatched compute scale in Asia

– Diversification beyond U.S. AI hubs

– Potential for green data center best practices

Cons:

– Regulatory uncertainty (China/U.S. friction)

– Massive energy consumption and sustainability scrutiny

– Single-region risk

—

10. Actionable Takeaways & Tips

1. Monitor Trends: Stay updated on AI infrastructure developments—new alliances could shift market dynamics overnight.

2. Plan for Export Disruptions: Multicloud and hybrid deployments can provide insurance against geopolitical shocks.

3. Invest in Efficiency: Focus on software- and hardware-level optimization to make the most of available compute.

—

Conclusion

The Foxconn-Nvidia colossus in Taiwan isn’t just a tech story—it’s a harbinger of the AI-powered economy, with ripples that will touch business, geopolitics, and everyday life worldwide. Whether you’re a tech leader, investor, or policy watcher, now’s the time to tune in, adapt, and prepare for the AI infrastructure revolution.

For ongoing industry insights, check the official channels:

– Foxconn

– Nvidia