- Nvidia leads the AI semiconductor industry with its innovative GPUs, indispensable for advanced AI models.

- Facing a 12% stock decline in a turbulent market, Nvidia’s history suggests potential for resurgence.

- Holding a dominant position in the AI chip supply chain, Nvidia reported $115.2 billion in data center GPU revenue for fiscal 2025.

- Strategic alliances, like the 70% access to TSMC’s chip packaging, prepare Nvidia for increased production of Blackwell AI GPUs.

- A growing demand for Blackwell chips aligns with Nvidia’s supply chain enhancements for future growth and market confidence.

- Analysts predict a 50% boost in revenue and earnings by 2026, aided by improved gross margins from optimized Blackwell production.

- Analyst confidence shows 82% recommending a ‘buy’ for Nvidia, forecasting a potential return to previous stock highs.

- With an appealing forward price-to-earnings ratio, Nvidia represents a promising investment in the advancing digital arena.

A whirlwind of innovation, Nvidia stands as the undisputed titan in the high-stakes arena of artificial intelligence semiconductors, deftly weaving the fabric of future technologies. The multinational juggernaut, known for its state-of-the-art graphics processing units (GPUs), carved a commanding niche by powering the intricate AI models that are transforming industries before our very eyes.

Yet, even giants face turbulence. Nvidia’s stock has languished, shedding 12% of its value in the tempestuous market of 2025. But if history whispers truths through the rustling leaves of financial markets, then Nvidia could very well rise again, phoenix-like, from this current quagmire.

Venture beneath the surface, and one discovers a fortress-like grip over the AI chip supply chain fortifying Nvidia’s prospects. Their data center GPU market supremacy showcases a staggering $115.2 billion in revenue for fiscal 2025 alone, dwarfing the combined might of rivals AMD and Intel. Such domination doesn’t just happen—it’s forged through strategy, innovation, and relentless ambition.

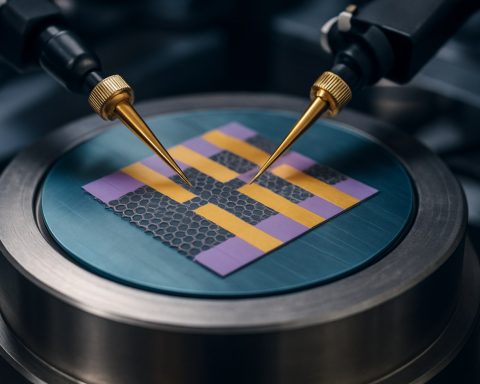

Another feather in Nvidia’s cap lies in its strategic partnership with Taiwan Semiconductor Manufacturing (TSMC). Locking down 70% of TSMC’s sophisticated chip packaging capabilities, Nvidia is poised to capitalize on the anticipated doubling of production capacity in 2025. This strategic move signifies a conscious effort to meet—and thrive amidst—the surging demand for their latest Blackwell AI GPUs.

Industry whispers tell of a burgeoning appetite for these cutting-edge Blackwell chips, creating a tantalizing gap between supply and feverish demand. An enhanced supply chain promises to be the bridge over which Nvidia will cross towards accelerated growth, turning whispers into roaring vindication.

Even as fiscal projections paint ripples of concern, Nvidia’s robust strategy injects quiet confidence into the market’s veins. Analysts are recalibrating their expectations with an optimistic brush, sketching visions of revenue and earnings leaping by an impressive 50% come 2026. This optimism finds roots in practicalities—once Nvidia optimizes Blackwell’s production, their gross margins are set to glide from the low-70% range to a promising mid-70% realm.

Eighty-two percent of analysts currently signal a ‘buy’ for Nvidia’s stock. Such overwhelming faith is not misplaced. As fiscal winds shift and calm, Nvidia’s shares could surge towards the heights of their 12-month median price target, seizing back lost ground with a vengeance.

With a current attractive forward price-to-earnings ratio, Nvidia entices those who dare to imagine its potential resurgence. For investors with a penchant for foresight, Nvidia represents more than just a company—it embodies the unfurling tapestry of tomorrow’s digital landscape, promising bountiful rewards to those with the acuity to harness its momentum. As artificial intelligence unfurls its myriad wings, Nvidia stands ready to soar anew.

Why Nvidia’s Market Dominance in AI Semiconductors is Poised for a Resurgence

Key Factors Driving Nvidia’s Potential Comeback

Nvidia continues to lead the AI semiconductor industry, despite recent market challenges. Here’s a deep dive into untapped insights and strategies that could bolster Nvidia’s ascendance in the coming years.

Technological Advancements

Nvidia’s evolution in AI chips, especially the Blackwell series, positions it to dominate future technological landscapes. The Blackwell AI GPUs promise unprecedented capabilities that cater directly to the explosive demand from industries leveraging AI for enhanced analytics, automation, and machine learning tasks.

Real-World Use Cases:

– Healthcare: Improve diagnostic accuracy with AI-powered image processing.

– Automotive: Elevate self-driving vehicle algorithms with superior real-time processing.

– Finance: Enhance predictive analytics to better manage assets and risks.

Strategic Partnerships and Supply Chain Control

Nvidia’s partnership with Taiwan Semiconductor Manufacturing Company (TSMC) secures a hefty 70% of their advanced chip packaging capabilities. TSMC’s production scaling is crucial, as it promises to satisfy the growing appetite for Nvidia’s highly sought-after chips.

Market Forecast and Industry Trends

The AI chip market is undergoing rapid expansion. Market research indicates a projected compound annual growth rate (CAGR) exceeding 20% through the next decade. As Nvidia refines its production processes, the opportunity to capture larger market segments becomes tangible.

Controversies & Limitations

Despite Nvidia’s stronghold in AI semiconductors, there are constraints, such as reliance on external manufacturing and geopolitical tensions affecting supply chains. Furthermore, consumer markets are continually driven by pricing competition from AMD and Intel.

Reviews & Comparisons

Evaluations reveal that while AMD and Intel offer competitive products, Nvidia’s GPUs consistently outperform in benchmark tests related to AI workloads and gaming. For instance, comparisons show a performance leap of 15-20% in Nvidia’s favor.

Financial Outlook and Investor Confidence

Nvidia anticipates a robust rebound with expectations of a 50% increase in revenue and earnings by 2026. Analysts favor Nvidia stocks, with 82% suggesting a ‘buy,’ largely due to the anticipated stabilization and growth in the AI sector.

Quick Financial Insight:

– Forward P/E Ratio: Nvidia’s current forward price-to-earnings ratio remains attractive, suggesting growth potential.

Actionable Recommendations

For potential investors and casual enthusiasts, here are steps to capitalize on Nvidia’s potential comeback:

1. Monitor Production Developments: Keep an eye on Nvidia’s supply chain improvements and TSMC’s production advancements.

2. Analyze Market Trends: Stay informed on AI industry trends to gauge Nvidia’s positioning.

3. Investor Strategy: Consider phased investments in Nvidia stocks, leveraging periods of instability for long-term gains.

Final Thoughts

As Nvidia continues to strengthen its strategic fortifications, including technological advancements and partnerships, the future seems promising. For those looking to tap into the rapidly expanding AI sector, Nvidia stands as a pillar of potential growth and innovation.

For a broader understanding of Nvidia’s products and innovations, explore their official website at Nvidia.