- Nvidia’s fiscal success is spearheaded by its dominance in data center GPUs, reflecting surging AI demand.

- In fiscal 2025, Nvidia’s Q4 revenue leapt 78% to $35.1 billion, and annual revenue soared 114% to $130.5 billion.

- The company’s high stock valuation, trading at 40 times earnings, suggests high investor expectations but leaves little room for error.

- Though growth remains strong, Nvidia’s revenue increase is slowing, from 265% last year to 78% recently, indicating potential challenges ahead.

- As competition in the AI market intensifies, Nvidia’s margins are slightly contracting, with gross profit margins dipping from 76% to 73%.

- Investors are advised to watch Nvidia closely, as current valuations may not fully reflect potential risks and competitive pressures.

- Given the high stakes, patience may be key, awaiting a more balanced risk-reward scenario before diving in.

Shimmering like a beacon in the tech industry, Nvidia has dazzled with its growth. The company’s recent fiscal performance is a testament to its dominance, especially in the realm of data center graphics processing units (GPUs), which power the skyrocketing demand in artificial intelligence (AI). In the fourth quarter of fiscal 2025 alone, Nvidia’s revenue soared by an astonishing 78% year-over-year, reaching $35.1 billion. The entire fiscal year painted a similar picture of success, with revenues climbing a staggering 114% to $130.5 billion.

Yet, there’s a brewing tempest on the horizon, casting shadows on this luminous growth trajectory.

Despite these eye-catching numbers, Nvidia’s stock floats in the skies of speculation, priced at a premium that assumes flawless execution for years, if not decades, ahead. The company trades at approximately 40 times its earnings, a multiple that leaves little margin for error and underscores high expectations. But what if these burgeoning expectations are confronted with a cooler reality?

Delving deeper into Nvidia’s growth trajectory, signs of slowing momentum emerge. Previously galloping at breakneck speed, its revenue growth rate now shows signs of softening. For instance, the 78% jump in Q4 pales compared to the 94% rise from three months prior and the astronomical 265% hike a year ago. This deceleration, while not alarming in isolation, hints at potential vulnerabilities in Nvidia’s otherwise robust playbook.

As the gleaming AI market matures, crowded with new competitors, Nvidia might face shrinking breathing room. The cost of maintaining its technical edge could surge as challengers vie for a piece of the pie. This is already evident as Nvidia’s gross profit margin contracted slightly from 76% to 73% compared to the same quarter the previous year.

If Nvidia’s revenue growth decelerates while facing tighter margins, the math behind its lofty valuation starts to show strain. The stakes are high. Should performance falter, the current premium could quickly appear overstretched, leaving investors with less room to maneuver.

Patience, it seems, may be the prudent path for would-be investors. As semiconductor titans intensify their race to close the gap in the AI chip arena, Nvidia’s pricing power and market dominance could face unforeseen pressures. For investors captivated by AI’s allure, biding time until Nvidia’s shares reflect a more balanced risk-reward ratio might be the wisest strategy.

In a world driven by rapid technological evolution, Nvidia is an undisputed leader. However, the art of investing demands more than admiration. It calls for careful consideration of what lies beneath the surface sheen. For now, keeping Nvidia on the watchlist, rather than the buy list, might just be the right move.

Nvidia’s Meteoric Rise: Navigating the Challenges and Opportunities Ahead

Overview

Nvidia has solidified its position as a dominant force in the tech industry, driven primarily by its leadership in data center GPUs powering artificial intelligence (AI). The company’s fiscal 2025 performance demonstrated exceptional growth, with revenue soaring by 78% in Q4 and 114% over the entire year. However, challenges and potential headwinds loom, addressing which will be crucial for sustaining its soaring stock valuation and market dominance.

Key Insights and Industry Trends

1. AI Market and Competitive Landscape: With the AI sector’s exponential growth, Nvidia’s dominance is facing stiffer competition from other semiconductor giants eager to capture market share. Companies like AMD, Intel, and even new entrants such as Google’s Tensor Processing Units (TPUs) are intensifying the competitive pressures.

2. Investment Strategy and Valuation: Nvidia currently trades at roughly 40 times its earnings, which may seem overvalued, especially with signs of growth rate deceleration. Historically, stocks with such high multiples require sustained growth and often become volatile if expectations aren’t met.

3. Profit Margins and Cost Pressures: While Nvidia boasts strong profit margins, the dip from 76% to 73% signifies pressure from increased competition and higher R&D expenses. Maintaining margins will require continuous innovation and efficient production strategies.

4. Technological Leadership and R&D Investment: Nvidia’s leadership hinges on continual technological advancements in its GPU architecture. Investing heavily in R&D is crucial to fend off competition and keep its products ahead of the curve.

5. Market Forecast and Future Opportunities: The demand for GPUs isn’t limited to AI but spans virtual reality, gaming, and cryptocurrency mining. These sectors provide diversification opportunities but also come with cyclical risks.

Real-World Use Cases of Nvidia Technology

– Healthcare: Advanced GPUs power AI-driven diagnostics and imaging, facilitating rapid and accurate analysis, potentially revolutionizing personalized medicine.

– Autonomous Vehicles: Nvidia’s DRIVE platform is integral in developing self-driving technology, a market expected to witness significant growth.

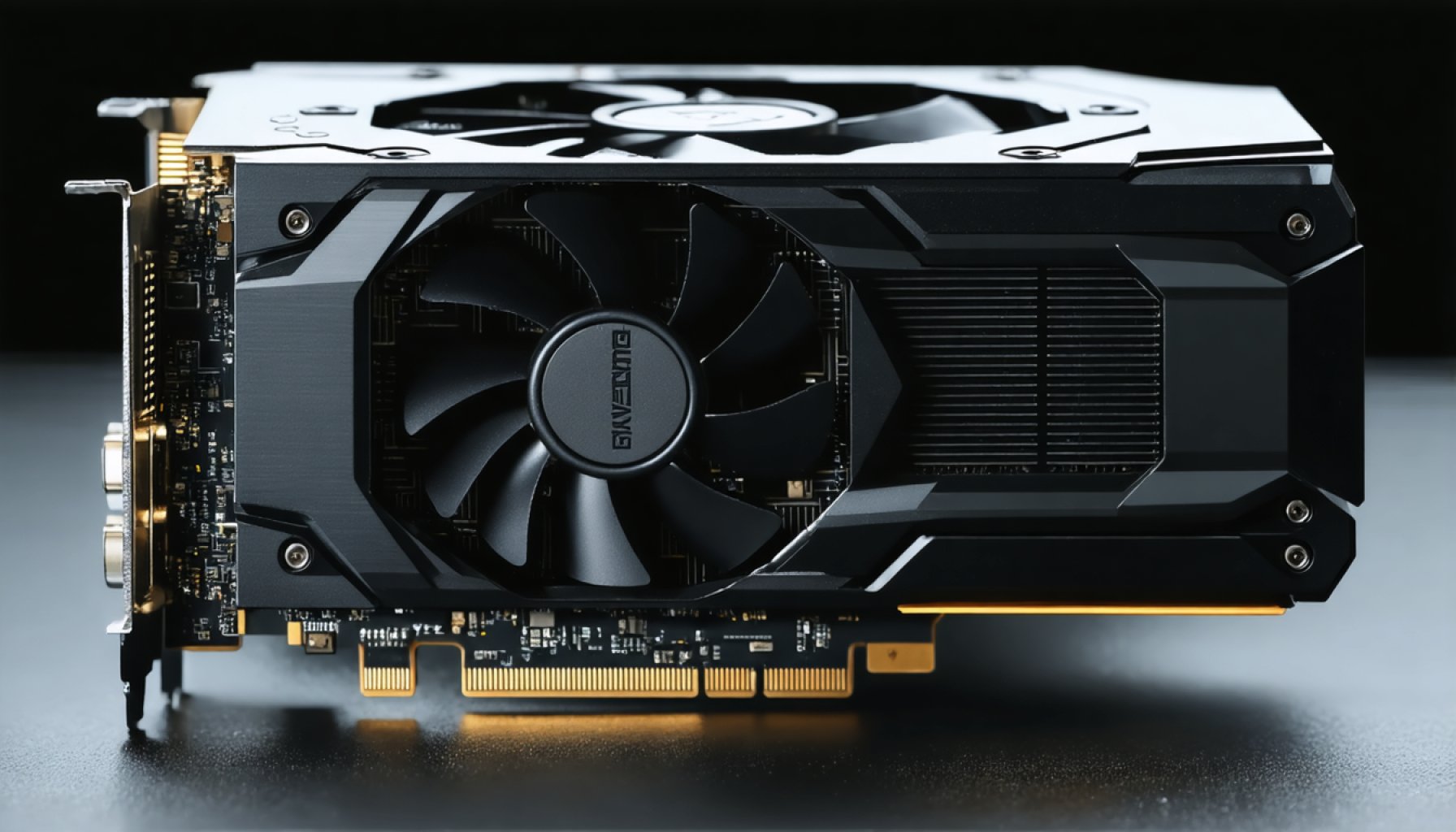

– Gaming and Graphics: Nvidia’s RTX GPUs remain the gold standard for gaming and visual rendering, highlighted by their ray-tracing capabilities.

Pressing Questions and Answers

Q: Is Nvidia’s valuation sustainable in the long term?

A: While the company’s dominance supports high valuations, a combination of market saturation, rising competition, and economic factors could affect sustainability. Continuous innovation and market expansion are essential to maintain its valuation.

Q: How vulnerable is Nvidia to economic downturns?

A: Like most tech companies, Nvidia might face challenges during economic slowdowns. However, its diversified product applications across various industries could mitigate some risks.

Q: What should potential investors consider?

A: Investors should be cautious of Nvidia’s high valuation and monitor market trends and company performance. Patience could be key, considering potential stock price corrections if growth wanes.

Actionable Recommendations

– Monitor Industry Developments: Keep an eye on advancements by Nvidia’s competitors and breakthroughs in AI and GPU technology.

– Diversify Investments: Consider a diversified portfolio to balance exposure to high-growth tech stocks like Nvidia with less volatile sectors.

– Evaluate Economic Indicators: Pay attention to macroeconomic indicators that could impact consumer spending and technological investments, influencing Nvidia’s core markets.

For those interested in exploring more about Nvidia and its product offerings, visit the official [Nvidia website](https://www.nvidia.com).

In conclusion, while Nvidia’s trajectory has been extraordinary, the combination of market conditions, competition, and economic factors should guide investment decisions. Balancing optimism with caution will be crucial for those intrigued by Nvidia’s promising yet challenging road ahead.