November 2, 2025

Samsung Wallet’s Shockingly Good Upgrades: The One App That Could Replace Your Wallet

November 1, 2025

You Can Fix Your Own iPhone 17… But Prepare for Sticker Shock

October 30, 2025

Epic’s Big Win Cracks Open Google Play Store: Android Devs Can Ditch Google’s Billing

October 29, 2025

iOS 26’s ‘Liquid Glass’ Overhaul: Hidden Features Revealed and Why It Has Users Divided

October 29, 2025

Huawei’s Ultra-Thin Mate 70 Air Leak Sparks “iPhone Air Killer” Buzz

October 28, 2025

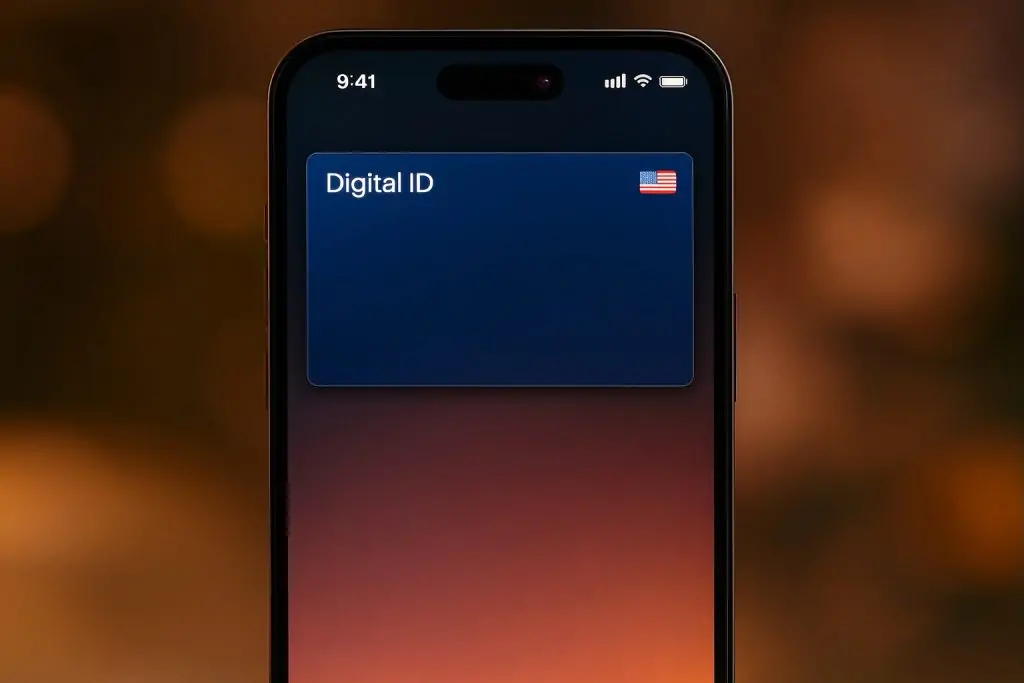

Your iPhone Could Replace Your Passport Sooner Than You Think

October 28, 2025

Now You Can Venmo Your Rent – PayPal’s New Partnership Adds Rewards to Housing Payments

October 27, 2025

Samsung’s October 2025 Security Blitz: Crucial Patch Hits Galaxy Z Fold 7, S25, S24 & More