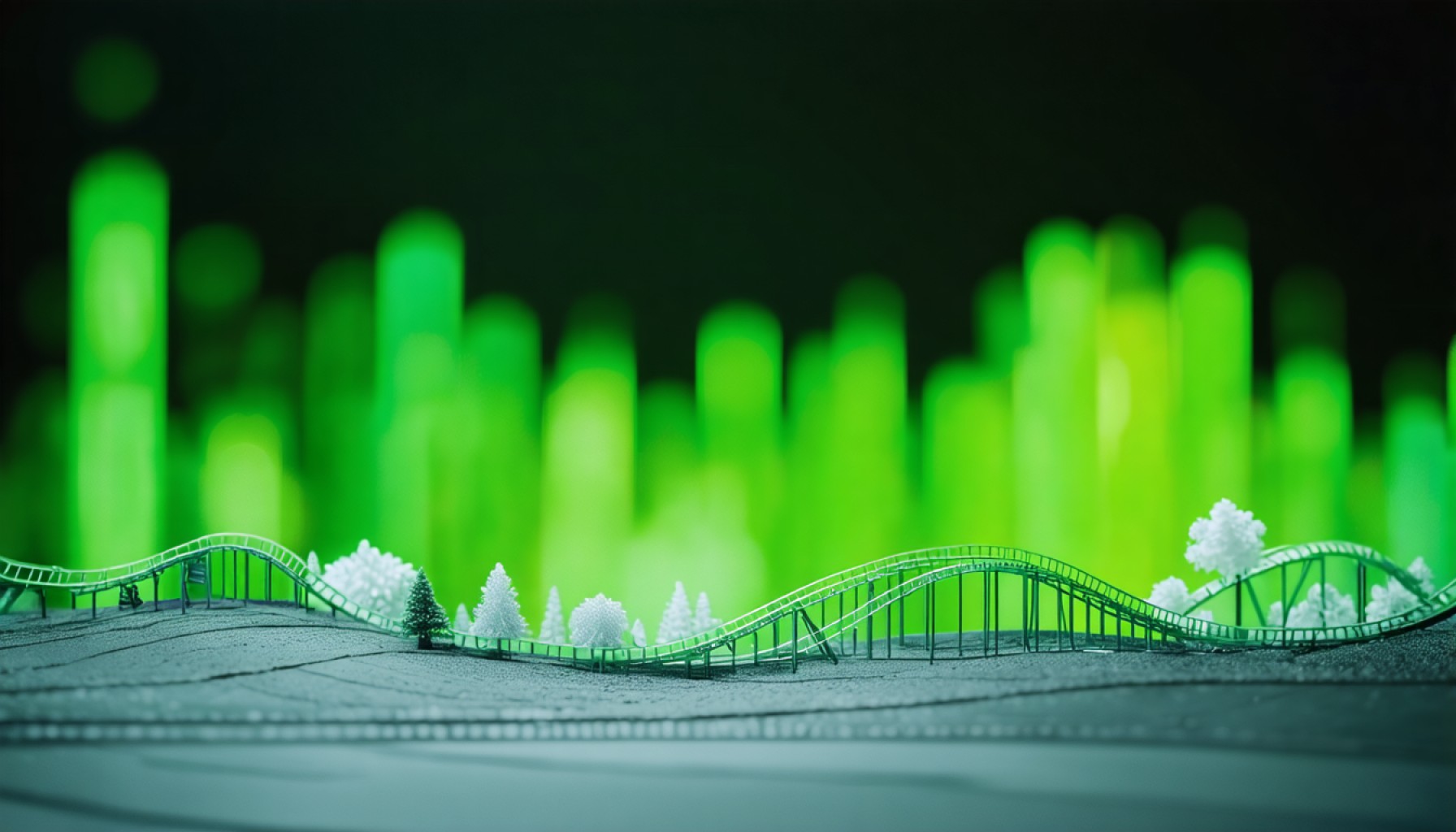

- Artificial intelligence stocks are experiencing significant volatility, presenting both risks and opportunities for investors.

- Nvidia’s stock declined by 12.7% in one week, with a potential relief rally providing a chance for investors to rebalance their portfolios.

- Snowflake, a leader in AI-driven cloud data management, sees its stock as a long-term investment despite recent declines.

- Palantir, involved in key U.S. Army AI projects, offers strategic value though timing may not favor new investments, per expert Quint Tatro.

- Navigating AI stock investments requires strategic timing: knowing when to buy, hold, or sell can unlock latent potential.

- Overall, AI remains central to technological advancement, offering promising prospects for discerning investors.

Amidst the swirling storm of the current market landscape, artificial intelligence stocks have taken a notable plunge, leaving investors scrambling to make sense of the volatility. Yet, within this tumult lies both risk and opportunity. Insight from Quint Tatro, an experienced market strategist and the mastermind behind Joule Financial, sheds light on how investors can navigate the waves with savvy decisions.

Nvidia, the Silicon Valley titan renowned for its trailblazing graphics processing units, has seen its shares drop a hefty 12.7% in a blink-quick week. Once riding high on the AI adoption frenzy, Nvidia now finds itself at a possible juncture; a point where the market’s instinctive response to overselling might be met with a relief rally. Savvy investors who have watched with a mix of anxiety and hope might see the expected bounce as a strategic moment to recalibrate their holdings. As Tatro suggests, this potential rally might just be the chance to “lighten the position” before the market recalibrates.

Meanwhile, Snowflake embodies the core of AI’s burgeoning software sector. Known for its cloud-based data warehousing capabilities, the company stands at the forefront of aiding entities in harnessing their vast datasets efficiently. Despite looming at a P/E ratio many traditional investors would balk at, Snowflake triumphs with accelerating earnings growth. With shares dipping by 12% recently, Tatro hints that this could be the window for a long-term positioning. Here lies Snowflake’s charm: a data powerhouse, enabling enterprises to intertwine AI for greater efficiency and profit margins.

As tensions brew among economic headwinds, Palantir stands as a steadfast partner in illuminating data-driven insights, now caught under the spotlight of the U.S. Army’s AI initiatives. The monumental collaboration highlights a burgeoning trust in private-public software synergies. Palantir’s recent modest downturn doesn’t eclipse its strategic allure. As Tatro emphasizes, despite the timing not being ripe for fresh investments, disengaging from the stock amid current dips would only mean sidestepping its promising trajectory.

The key takeaway from Tatro’s analysis is not just about market volatility but about seeing the forest through the trees. For investors, the fluctuating graphs of Nvidia, Snowflake, and Palantir may appear daunting—but beyond the zigzag of the ticker lies an unfolding narrative of AI evolution and innovation. The art is in timing: to recognize when to leap, hold, or bid farewell. With AI continuing to be the vital artery of technological advancement, these stocks—though presently teetering—hold latent potential waiting to be unlocked by those wise enough to discern their intrinsic value.

Unveiling the Opportunities in AI Stocks Amid Market Volatility

In the ever-evolving landscape of artificial intelligence stocks, recent market fluctuations present both challenges and opportunities for investors looking to capitalize on the future of technology. Key players like Nvidia, Snowflake, and Palantir have encountered significant shifts, prompting an examination of strategic moves to navigate this dynamic market effectively. Here, we delve deeper into their potential, offering insights, trends, and actionable strategies for investors.

Market Overview and Trends

Nvidia: Known for its revolutionary graphics processing units (GPUs), Nvidia has experienced a recent downturn with a 12.7% drop in shares over a single week. Despite this, Nvidia remains a powerhouse within the AI sector due to its GPUs being essential for AI and machine learning applications. The company is poised to grow as AI integration across industries increases, encompassing sectors like healthcare, automotive, and entertainment. The dip offers a potentially strategic entry point for investors considering Nvidia’s long-term growth potential.

Snowflake: Specializing in cloud-based data warehousing solutions, Snowflake has seen its stock dip by 12%. Despite this, the company continues to exhibit robust earnings growth, driven by the ubiquitous need for data analytics and the integration of AI to enhance business efficiencies. Organizations are increasingly relying on Snowflake’s platform to manage and extract insights from their data, positioning it as a critical player in the software sector with sustainable growth prospects.

Palantir: As a key partner in data analytics for governmental and commercial clients, Palantir is at the forefront of AI-driven insights. Its involvement with U.S. Army AI projects symbolizes a growing trust in its capabilities. While experiencing some downturns, Palantir’s strategic partnerships indicate long-term robustness. Investors should monitor public-private collaborations that Palantir secures, as these are likely to impact its growth trajectory positively.

Strategies for Navigating AI Stocks

1. Diversification: Spread investments across different sectors and companies within the AI field to mitigate risks associated with individual stock volatility.

2. Long-Term Positioning: Given the inherent volatility of AI stocks, long-term holding strategies can capitalize on future growth. Companies like Nvidia and Snowflake, despite short-term fluctuations, continue to show potential for substantial returns over time.

3. Monitoring Economic Indicators: Stay informed about broader economic trends that could impact AI adoption, including regulatory changes, technological advancements, and macroeconomic factors.

4. Strategic Buy Points: Utilize market downturns as opportunities to buy shares at lower prices, with a focus on companies with strong fundamentals and growth potential, like Nvidia and Snowflake.

Industry Outlook and Predictions

The AI industry is anticipated to grow exponentially, with estimates suggesting a market size surpassing $500 billion by 2027 (Source: Grand View Research). Sectors such as autonomous vehicles, healthcare, and SaaS (Software as a Service) are expected to drive demand for AI technologies.

Pros and Cons Overview

Pros:

– High growth potential with increasing adoption of AI technologies.

– Strategic collaborations with government and private sectors enhance company prospects.

– Rising need for data management and analytics strengthens companies like Snowflake.

Cons:

– High volatility and susceptibility to market fluctuations.

– Dependence on continued technological innovation and adoption.

– Potential regulatory challenges impacting tech sectors.

Conclusion: Actionable Recommendations

For astute investors ready to navigate the current volatility in AI stocks, consider the following:

– Evaluate the intrinsic value and growth prospects of key AI companies.

– Prioritize diversification to minimize risks.

– Use market dips as entry points for long-term holdings.

By leveraging these insights and strategies, investors can position themselves to maximize returns in the dynamic AI sector.

For more information and to stay updated on financial trends, visit CNBC and Bloomberg.