Overview of Emerging AI Trends

The tech world is buzzing about artificial intelligence (AI), especially after the introduction of Palantir’s Artificial Intelligence Platform (AIP) in 2023. While major companies like Nvidia and Microsoft grab headlines, Palantir is carving out a niche that’s gaining attention.

Palantir’s Rising Stock Performance

Currently, Palantir Technologies is making waves as one of the top-performing stocks within the S&P 500 for 2024. Much of this success is attributed to the excitement surrounding its AIP, which many investors recognize for its applications in the private sector.

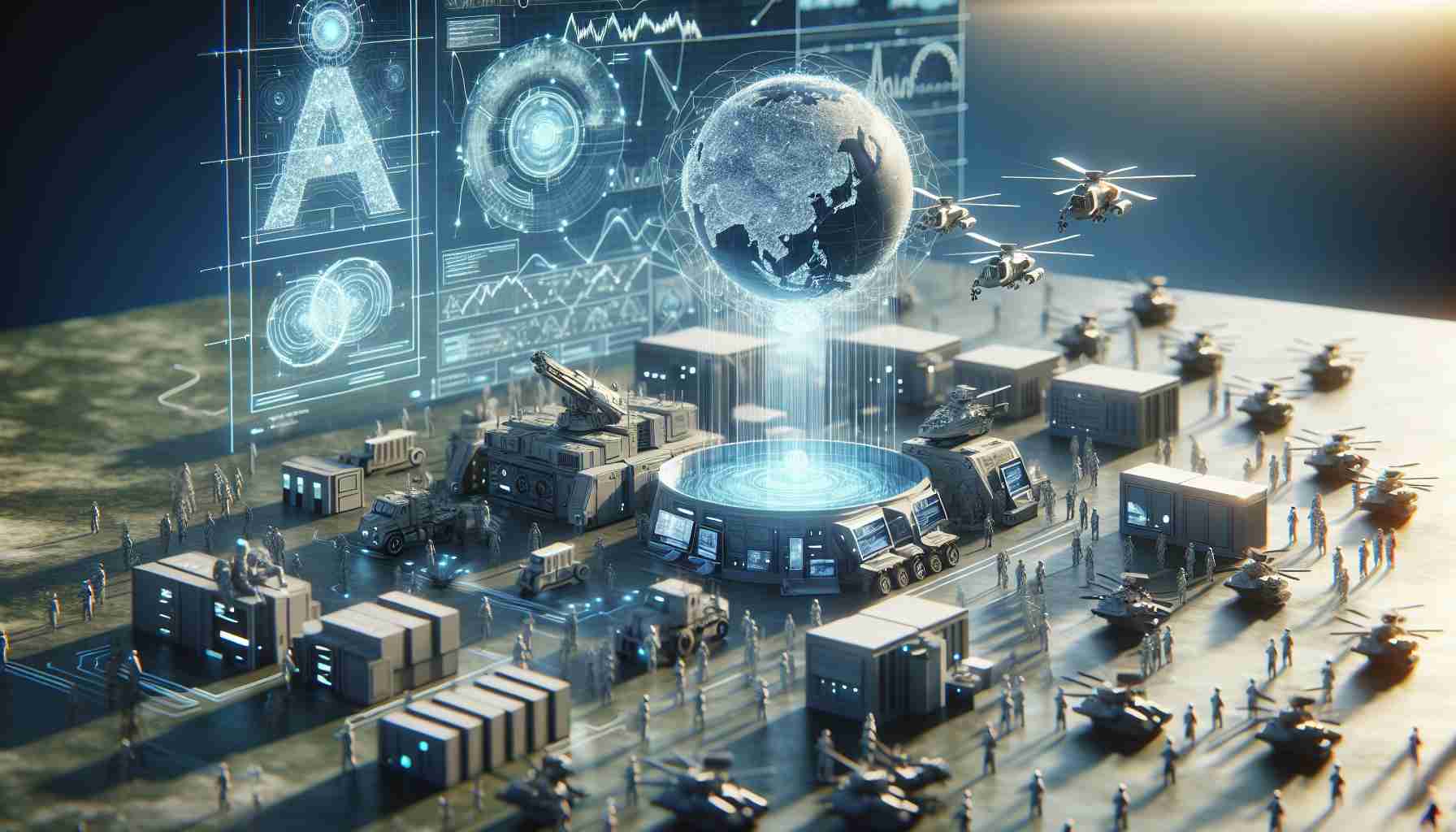

The Military AI Landscape

However, a crucial aspect often overlooked is Palantir’s involvement in military operations. The defense sector is a burgeoning field for AI, with projected market opportunities exceeding $60 billion, encompassing areas like data analytics and robotics.

Key Partnerships Amplifying Growth

Palantir has partnered with giants like Microsoft and Amazon Web Services to integrate AIP into secure environments across the Department of Defense (DoD). Recently, they also joined forces with Meta, showcasing the versatility of their technology across multiple platforms.

Lucrative Contracts and Future Goals

Beyond tech alliances, Palantir has secured significant government contracts, including a notable $1 billion agreement with the Naval Information Warfare Center. These deals underscore the company’s momentum and potential for substantial growth in the military sphere in the years ahead.

Conclusion: A Bright Future for Palantir

Investment in Palantir seems prudent as its government engagements and partnerships thrive, promising further advancements in AI within the defense sector.

Palantir’s AI Revolution: Navigating the Future of Military and Commercial Sectors

Overview of Emerging AI Trends

The continuous evolution of artificial intelligence (AI) is a hot topic in the tech industry, with Palantir’s Artificial Intelligence Platform (AIP) emerging as a key player. Since its introduction in 2023, AIP has been designed to cater to a wide range of applications, making Palantir a significant competitor against larger tech giants like Nvidia and Microsoft.

Palantir’s Rising Stock Performance

Palantir Technologies has become a standout performer in the S&P 500 for 2024, demonstrating remarkable stock performance largely driven by the growing interest in its AIP. This surge reflects investor recognition of the platform’s potential, particularly in the private sector where businesses are keen to harness AI to enhance operational efficiency and decision-making processes.

The Military AI Landscape

The military sector is rapidly evolving, with AI poised to redefine how defense operations are conducted. The market for military AI is projected to exceed $60 billion, encompassing critical areas such as data analytics, cybersecurity, autonomous systems, and advanced robotics. Palantir’s involvement in this domain not only positions it favorably but also underscores its importance in national security strategies.

Key Partnerships Amplifying Growth

Strategic partnerships are a cornerstone of Palantir’s business model. Collaborations with industry leaders such as Microsoft and Amazon Web Services have been instrumental in facilitating the integration of AIP within secure government frameworks. Recently, Palantir’s alliance with Meta further exemplifies the adaptability of its technology, allowing it to serve diverse applications across various sectors, including social media and cybersecurity.

Lucrative Contracts and Future Goals

Palantir’s ability to secure substantial government contracts further solidifies its future growth potential. Notably, the company recently inked a $1 billion contract with the Naval Information Warfare Center, highlighting its critical role in defense technology deployment. Such agreements are not just a boon for revenue; they are indicative of the long-term importance of AI in enhancing military capabilities.

Pros and Cons of Investing in Palantir

Pros:

– Strong partnerships with leading tech companies enhancing its market presence.

– Robust stock performance in a growing sector.

– Significant government contracts indicating reliability and trustworthiness.

Cons:

– Dependency on government contracts could pose risks if market dynamics shift.

– Competition with larger firms could pressure profit margins and market share.

Future Trends and Insights

Looking ahead, Palantir is well-positioned to capitalize on trends favoring AI adoption, especially in sectors requiring high-level data analysis and security. As the landscape of military and private sector applications continues to expand, Palantir’s technology is likely to play a pivotal role in driving innovation.

Conclusion: A Bright Future for Palantir

Given its impressive growth trajectory fueled by key partnerships and lucrative contracts, investing in Palantir appears to be a strategic move for those looking at the AI landscape. With a solid foundation in military applications and an expanding commercial footprint, Palantir is set to lead the charge into a future driven by artificial intelligence. For more insights and information on the latest in technology trends, visit Palantir Technologies.