- XRP defies turbulent markets, aspiring to reach a two-digit price, fueled by a classic symmetrical triangle pattern.

- Since its peak of $3.8 in January 2018, XRP has followed a seven-year trajectory of lower highs and higher lows.

- Analyst Ali Martinez remains optimistic about a potential rally to $15 despite current declines and a 29% drop from its mid-January $3.4 high.

- A notable 283% surge in XRP’s value in November 2024, driven by global political shifts, highlights potential cyclical growth.

- Future growth hinges on overcoming the $2.5-$2.62 resistance level, while ongoing volatility remains a challenge.

- Understanding technical formations, like the symmetrical triangle, could benefit astute investors navigating XRP’s potential path to $15.

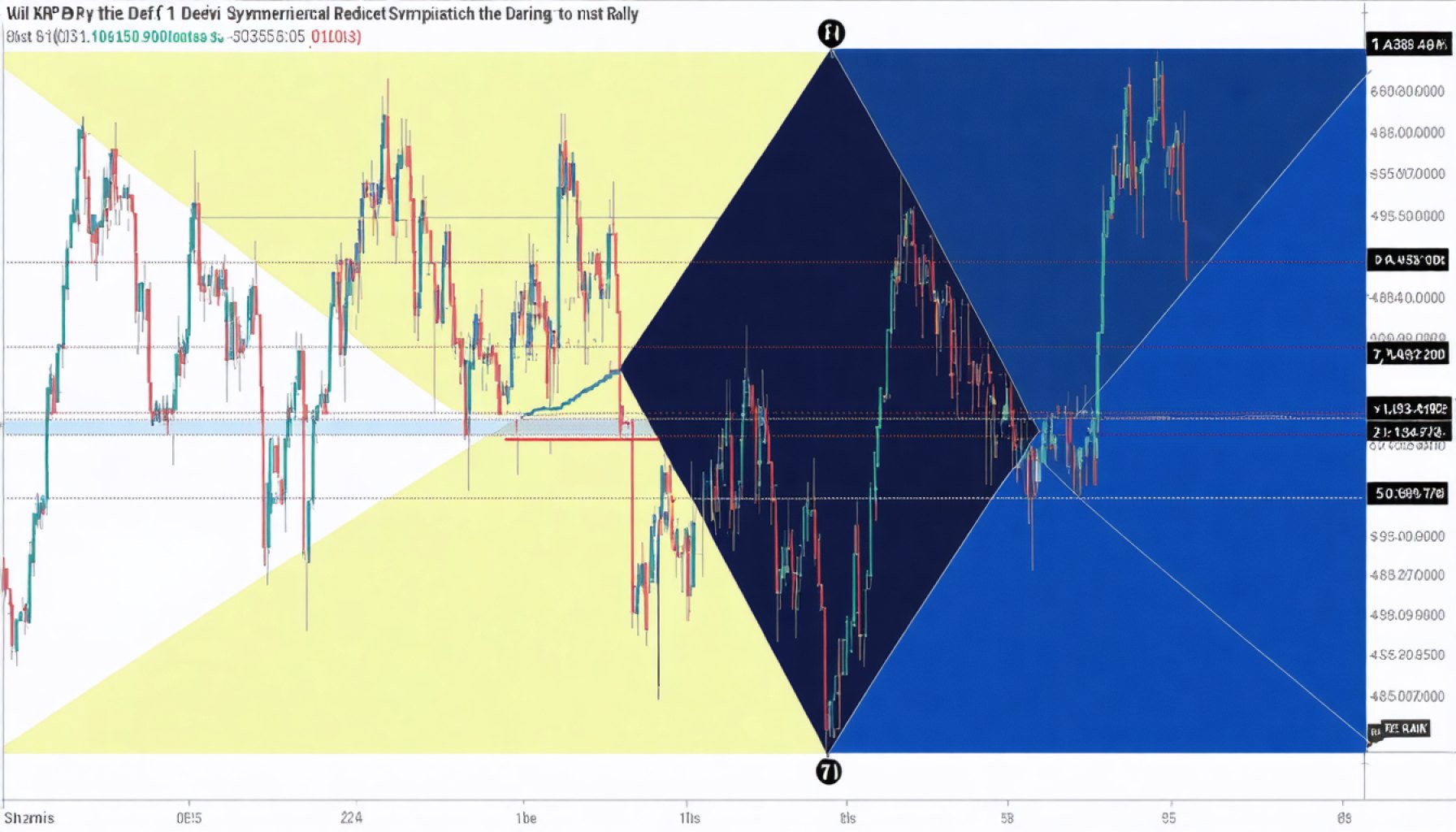

Glimpses of promise flicker amid turbulent market seas as XRP, the renowned digital asset, clings to unlikely ambitions of scaling the heights of a two-digit price this cycle. This newfound hope springs from a robust, age-old technical pattern known to seasoned traders and optimists alike: the symmetrical triangle.

A numinous seven-year journey begins in January 2018, tracing the undulating path of XRP as it tumbled from its $3.8 peak. Market veteran and analyst Ali Martinez paints a vivid picture of this saga, illustrating how the digital currency’s lower highs and higher lows cinched a classic symmetrical triangle, brimming with the potential energy of a thousand waiting suns.

Yet amid today’s uncertainties, XRP’s once-glorious days seemed buried under layers of market pressures, its value plummeting nearly 29% from a fleeting $3.4 achieved mid-January. In the shadows of these losses stands Martinez’s unwavering belief: despite current downturns, an invigorating rally to $15 remains within reach.

November 2024 heralded a breakthrough, as XRP shattered the confines of its triangle, soaring an extraordinary 283% on the momentum of global political shifts. This tumultuous rise draws attention, signaling more than a fluke—it heralds a larger cycle driven by technical realities unmarred by temporal setbacks.

Yet, the market roller-coaster offers no simple rides. Martinez acknowledges a necessary retest—a gentle descent as XRP now recalibrates amidst broader market dips. Dips, like these, often foreshadow a confirmed breakout, reverberating strength for future triumphs.

Challenges loom. A sell wall between $2.5 and $2.62 stands like sentinels, as noted by analyst CW. This barrier must crumble under the weight of momentum before XRP sails smoothly toward the $2.8 mark, setting the stage for future aspirations.

In the enigmatic dance of markets, volatility remains the only constant. For XRP, the path from $2.43 to $15 demands a herculean rise—yet the allure of potential profits beckons the brave. In the symphony of charts and forecasts, a key takeaway emerges: understanding the fundamentals behind technical formations like the symmetrical triangle could tilt the odds in favor of discerning investors.

As the digital horizon unfolds, will XRP’s journey inspire a new epoch of digital abundance, or is it merely the lore of a cyclical market pattern? Only time—and tenacious resolve—will tell.

Can XRP Break Free from Market Constraints? Exploring Future Price Dynamics

Understanding XRP’s Current Position

XRP has long been one of the most talked-about cryptocurrencies, largely due to its potential use cases and market dynamics. Despite recent volatility, there are several factors investors should consider when evaluating XRP’s future potential:

1. Technical Analysis: The symmetrical triangle pattern is a significant indicator in market analysis, suggesting a consolidation phase followed by a potential breakout. For XRP, the pattern indicates possible price surges, especially after historical price suppression since its 2018 peak.

2. Market Trends and Forecasts:

– Increased Adoption: The use of XRP in cross-border payments and financial services worldwide could strengthen its market position. As traditional financial systems incorporate blockchain technologies, XRP’s integration could act as a catalyst for its value appreciation.

– Regulatory Environment: Regulatory clarity, especially in the U.S., remains crucial. Favorable laws could propel XRP further, removing barriers that currently hinder its expansion.

3. Innovative Use Cases:

– Leveraging XRP for remittances offers speed and reduced transaction costs compared to traditional systems.

– Its integration into decentralized finance (DeFi) applications could expand its relevance and utility in the evolving digital ecosystem.

Real-World Use Cases and Industry Trends

– Financial Institutions: Major banks and financial institutions are exploring the use of XRP for cross-border transactions due to its efficiency. This has been a driving force behind its sustained interest.

– Market Predictions:

– Analysts predict that if XRP breaches the $2.8 resistance and gains regulatory endorsement, a rally to $10 and beyond might be plausible under favorable conditions.

Controversies and Limitations

– SEC Lawsuit: Ripple Labs, the company behind XRP, is involved in an ongoing lawsuit with the SEC over the classification of XRP as a security. The outcome is pivotal for XRP’s future.

– Market Volatility: Like most cryptocurrencies, XRP is highly volatile. Investors need to be cautious and consider market conditions before making decisions.

Insights and Predictions

– Expert Opinions: Seasoned analysts like Ali Martinez emphasize understanding technical charts like the symmetrical triangle to forecast potential price movements.

– Community and Research Consensus: The wider crypto community perceives XRP as having a resilient model due to its market-tested fundamentals and real-world applications.

Pros & Cons Overview

Pros:

– Potential for high returns due to volatile nature.

– Strong backing by financial institutions.

Cons:

– Legal uncertainties could impact value.

– High volatility may not suit conservative investors.

Actionable Recommendations

– Stay Informed: Regularly update yourself with the latest XRP news and technical analysis.

– Diversify Investments: Don’t put all eggs in one basket—consider a balanced portfolio.

– Use Stop-Loss Orders: Protect your investment by using stop-loss orders to minimize potential losses.

– Engage in Community Discussions: Participate in forums and webinars to gather various perspectives.

For continuous updates and insights on XRP and broader market trends, visit CoinDesk or CoinGecko. These platforms offer a wealth of information for both new and seasoned investors.