- Wall Street is experiencing a surge of optimism as economic pressures ease and inflation shows a slight dip to 2.8%.

- TSMC considers a groundbreaking alliance with Nvidia and Broadcom, aiming to revitalize Intel’s struggling foundry operations.

- This potential joint venture could breathe new life into Intel and expand innovation, carefully navigating political and proprietary challenges.

- The collaboration promises to alleviate supply constraints and meet growing demand driven by AI advancements.

- The stock prices of Intel, Nvidia, and Broadcom are positively impacted by the potential alliance.

- Success could herald a new era for semiconductors, defined by strategic collaboration and significant transformation.

- Investors and tech enthusiasts are eagerly observing, anticipating a revolution in technology through this strategic move.

As the dust of economic pressures begins to settle, a thrilling surge of optimism electrifies Wall Street. In a climate where inflation feels like an unrelenting specter, fresh numbers show a glimmer of relief. Meanwhile, whispers of a groundbreaking collaboration ripple through the semiconductor industry, sending ripples that reach far and wide.

With the latest Consumer Price Index showing an unexpected dip to 2.8% in February, experts and consumers alike feel a cautious optimism. This deviation from the predicted 2.9% sparks confidence across financial markets, hinting that perhaps, just perhaps, the relentless rise in costs may be nearing its peak.

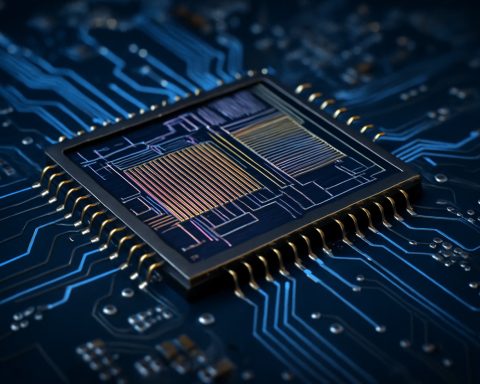

Against this backdrop, an audacious proposal from the realm of semiconductors captures imaginations. Industry giant Taiwan Semiconductor Manufacturing Company (TSMC) is contemplating a grand alliance involving Nvidia and Broadcom in what could be a game-changing joint venture. This plan envisions revitalizing Intel’s struggling foundry operations with a fresh infusion of expertise and capital.

TSMC, renowned for its mastery in semiconductor technology, aims to breathe new life into Intel’s operations while circumventing complete foreign ownership—a proposition requiring careful political maneuvering and potentially unlocking new frontiers of innovation. The timing couldn’t be more critical for Intel, which, despite its storied legacy, finds itself stranded amidst technological shifts and stiff competition.

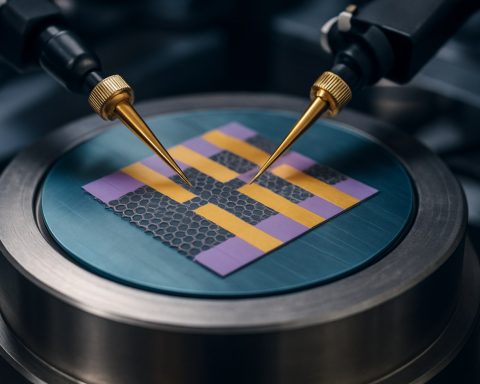

The nuances of semiconductor production involve more than nuts and bolts; they are intricate symphonies of cutting-edge developments. The combination of Nvidia’s AI-driven prowess, Broadcom’s technical acumen, and TSMC’s operational excellence promises a dramatic shift in the silicon landscape. But the stakes are high, with the complexity of differing processes and the safeguarding of proprietary secrets looming large over negotiations.

Yet, there is a glimmer of hope. Success in this venture could signify a renaissance for Intel, a reinvigoration that many believe will enable it to recapture lost ground in the marketplace. For Nvidia and Broadcom, such an alignment offers a pathway to alleviate supply constraints and capitalize on escalating demand, fueled by artificial intelligence revolutionizing sectors at an unprecedented pace.

Wall Street certainly seems to think so. The mere rumor of this alliance propels stock prices for these tech titans, injecting a dose of vitality into a sector poised on the precipice of significant transformation. Intel, Nvidia, and Broadcom embody the vital nerves of the tech industry. Their every movement echoes across financial markets and ripples throughout the global economy.

As these giants contemplate joining forces, the expectations—and implications—are colossal. While challenges abound, should they navigate this tightrope successfully, the potential rewards promise not just revival but revolution. In this chess game of technology, strategy, timing, and innovation will decide the victors. Investors and tech enthusiasts are watching with bated breath, hoping the dawn of a new era in the semiconductor world is upon us, an era where challenges are met not with resistance, but with collaboration and ingenuity.

Are We Witnessing a New Era in Semiconductors? Insights, Predictions, and More

Breaking Down the Impacts of Economic Changes on the Market

Recent shifts in economic indicators, particularly a drop in the Consumer Price Index to 2.8% in February when a rise to 2.9% was expected, have triggered cautious optimism. This deviation suggests possible stabilization in consumer prices, potentially easing the burden of inflation. For investors, this marks a potentially lucrative moment and a cue to explore growth opportunities in technology and semiconductor sectors.

Semiconductor Titans Consider Groundbreaking Alliance

TSMC’s Bold Move

Taiwan Semiconductor Manufacturing Company (TSMC), a leader in the semiconductor industry, is reportedly considering an alliance with Nvidia and Broadcom to reinvigorate Intel’s underperforming foundry operations. This proposal could reshape the semiconductor landscape if successful, creating a synergy tapping into TSMC’s manufacturing prowess, Nvidia’s expertise in AI, and Broadcom’s technological insights.

The Strategic Importance of This Alliance

1. Revival of Intel: Intel has faced challenges from technological changes and competition. An alliance could bring back its prominence, benefitting not just the company but potentially the entire semiconductor industry.

2. Strengthening AI Capabilities: Nvidia’s strengths in AI could leverage new processing technologies and help address growing demands across sectors revolutionized by AI.

3. Supply Chain Advantages: Broadcom and Nvidia are poised to tackle supply constraints, creating a stable environment to meet expanding global demand.

Market Forecast and Industry Trends

1. Global Semiconductor Market Growth: The semiconductor market is anticipated to grow, driven by demands in AI, IoT, and 5G technologies. According to a report by the Semiconductor Industry Association, the global semiconductor market is expected to reach $1 trillion by 2030, fueled by digital transformation and technology proliferation.

2. AI and Machine Learning: AI applications are expanding into various industries, from healthcare to automotive, increasing the need for robust semiconductor solutions.

Challenges and Considerations

1. Complex Negotiations: The collaboration between these giants requires navigating intricate manufacturing processes and safeguarding proprietary technologies. The question remains how effectively proprietary secrets can be maintained while fostering collaboration.

2. Political and Regulatory Hurdles: The proposal requires careful handling to avoid geopolitical frictions, especially concerning foreign ownership concerns.

Real-World Application and Use Cases

– Advancements in AI: With strengthened semiconductor solutions, industries such as healthcare could see accelerated advancements in AI-driven diagnostics.

– Automotive Innovations: Enhanced semiconductor technologies could spur the development of more sophisticated autonomous vehicles and smart transportation infrastructures.

Actionable Recommendations

– For Investors: Monitor developments closely. Rumors alone have influenced stock prices significantly. Evaluating the long-term strategic advantages of potential alliances could inform more stable, future-focused investment strategies.

– For Tech Enthusiasts and Professionals: Stay informed on technological advances resulting from these collaborations. Engaging with early previews and pilot technologies could offer a competitive edge in career advancement or innovation projects.

Conclusion: The Future Holds Collaborative Promise

In the volatile world of technology, strategic collaborations such as the one proposed by TSMC, Nvidia, and Broadcom could be the answer to overcoming persistent challenges. As semiconductor titans contemplate this bold synergy, stakeholders and observers alike should prepare for an exciting journey of collective innovation and industry transformation.

For more insights on semiconductor industry dynamics, visit the Semiconductor Industry Association.